Is there More Downside to Cliffs’s USIO Division Volume Guidance?

In its 2Q15 results, Cliffs Natural Resources (CLF) downgraded its volume guidance for the USIO division for 2015, from 20.5 million tons to 19 million tons.

Oct. 19 2015, Updated 12:08 p.m. ET

Volume downgrade

In its 2Q15 results, Cliffs Natural Resources (CLF) downgraded its volume guidance for the US iron ore (or USIO) division for 2015, from 20.5 million tons to 19 million tons. Cliffs mentioned lower capacity utilization among US steel mills as the major reason for the downgrade. In turn, lower utilization was due to heavy steel imports into the country.

Expectations from 2H15

Cliffs’s management was more optimistic regarding the second half of 2015. Management expects US steel imports to moderate in the second half of the year as steel imports respond to anti-dumping lawsuits filed by steelmakers. This could be one of the major catalysts for Cliffs to upgrade its volume guidance back.

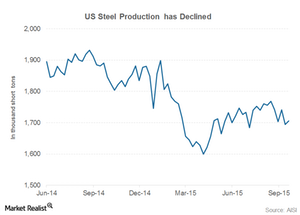

US steel production

However, steel imports into the United States don’t seem to have slowed down much, at least in 3Q15. As the above graph shows, the US steel production trend has mostly been downward to flat since June. Capacity utilization for US steelmakers is also quite low.

According to the Association of North American Steelmakers, the year-to-date steel production through October 10, 2015, was down 8% year-over-year (or YoY) while capacity utilization rates were 72.5%, lower than 77.8% recorded last year.

This in turn is negatively impacting US steelmakers, including US Steel (X), Steel Dynamics (STLD), Nucor (NUE), AK Steel (AKS), and ArcelorMittal (MT). Since Cliffs is the pellets supplier to US steelmakers, declining utilization rates and declining steel production in the United States is expected to negatively impact US sales volumes going forward. Nucor and US Steel form 8.1% of the SPDR S&P Metals and Mining ETF (XME).