Analyzing AT&T’s New Segment Reporting Structure

AT&T changed its segment reporting structure. Its new segments are Business Solutions, Entertainment and Internet Services, Consumer Mobility, and International.

Oct. 22 2015, Published 9:40 a.m. ET

AT&T’s segments

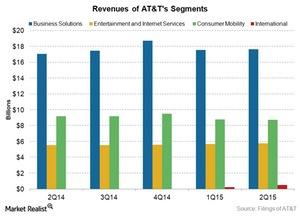

In the last part of this series, we learned that AT&T (T) thinks that Wall Street analysts’ revenue expectations are on the higher side for 3Q15. AT&T changed its segment reporting structure. According to the company, its new segments are Business Solutions, Entertainment and Internet Services, Consumer Mobility, and International. Now, let’s see how these parts performed during 2Q15.

Business Solutions

According to the company, Business Solutions includes both wireless and wireline business customers. In 2Q15, the segment’s revenue rose by ~3.6% YoY (year-over-year) to reach ~$17.7 billion. The contribution of wireless business customers drove the segment’s growth. Business Solutions’ revenue from the wireless component rose ~9.4% YoY to ~$9.5 billion during the quarter. Meanwhile, the revenue from the wireline component continued to fall in 2Q15.

Entertainment and Internet Services

According to AT&T, in the Entertainment and Internet Services segment, it offers video, Internet, and voice services largely to domestic consumers. According to the company, this segment will have DIRECTV’s operations in the US in 3Q15. Earlier, the segment’s revenue grew by ~4.0% YoY to ~$5.8 billion in 2Q15.

Consumer Mobility

The Consumer Mobility, or the domestic wireless, segment excludes business customers. In this segment, AT&T’s revenue continued to fall YoY during 2Q15. This segment’s revenue fell by ~4.8% YoY to ~$8.8 billion during the quarter. In the previous quarter, the segment’s revenue fell marginally by ~0.7% YoY.

International

According to the company, the International segment has AT&T’s video and wireless services in its non-US markets. This segment includes the results of AT&T’s Mexican wireless acquisitions of Iusacell and Nextel Mexico. According to the company, the segment will have DIRECTV’s Latin American operations in 3Q15. During 2Q15, the International segment’s revenue was ~$491 million.

Other US telecom players

Other US telecom players like Verizon (VZ) and Sprint (S) provide the segment results separately for their wireless and wireline divisions. T-Mobile (TMUS) is another wireless carrier.

Instead of taking direct exposure to AT&T’s stock, you could take diversified exposure to the company by investing in the iShares MSCI USA Minimum Volatility ETF (USMV). USMV had ~1.7% of its holdings in the telecom company at the end of August 2015.