Why Digital Media remains an integral segment for Adobe in 3Q14

The Digital Media segment of Adobe (ADBE) provides tools and solutions that enable individuals, businesses, and enterprises to create, publish, promote, and consequently monetize their digital content anywhere.

May 3 2021, Updated 10:51 a.m. ET

What is Digital Media and who are its customers?

The Digital Media segment of Adobe (ADBE) provides tools and solutions that enable individuals, businesses, and enterprises to create, publish, promote, and consequently monetize their digital content anywhere. Major customers of digital media include traditional content creators, web application developers, and digital media professionals.

If Adobe’s Digital Media segment continues to post good results, it would benefit ETFs like the Guggenheim S&P 500 Equal Weight Technology ETF (RYT) and the Technology Select Sector SPDR Fund (XLK), which have high exposure to Adobe.

Digital Media contributes the most to Adobe’s consolidated revenues

Digital Media contributes ~60%–64% of the company’s consolidated revenues. Creative Cloud and Document Services are its two segments. The “Creative Cloud suite of applications” consists of Adobe Photoshop, Adobe Illustrator, Adobe Dreamweaver, and Adobe InDesign.

Creative Cloud is the segment’s flagship offering. It includes Adobe Photoshop. The Document Services business encompasses the Acrobat family of products.

This segment provides solutions to content creators, web designers, and app developers. Microsoft (MSFT) and Apple (AAPL) are Adobe’s peers in this segment.

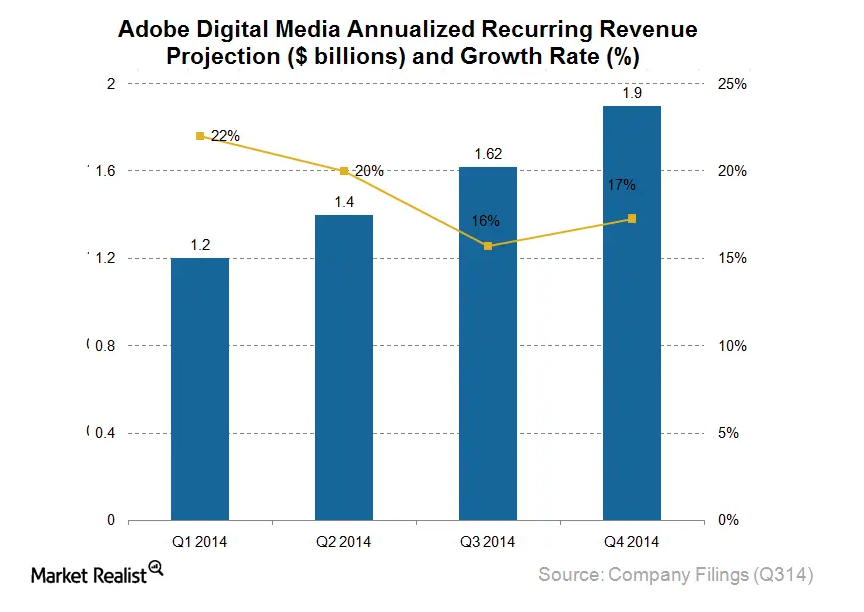

Creative Cloud growth is a key growth driver

With more than 2.8 million active subscriptions worldwide, as reported in 3Q14, Creative Cloud is one of the leading media creation suites available. Its product Photoshop CC remains a flagship product for Adobe. Increasing adoption of Creative Cloud, as is evident by the increase in subscriptions, is expected to be a key driver pushing Digital Media segment growth.

Increased focus on cloud offerings

By ending the perpetual licensing of Creative Suite 6, or CS6, from 3Q14, Adobe has now shifted its entire focus on its cloud-based product offerings in order to lure an increasing number of customers to subscribe to its Digital Media offerings.