Salesforce Launches Its Financial Services Cloud

On August 25, Salesforce, along with the announcement of its Lightning platform for its Sales Cloud, launched Financial Services Cloud, its first industry-specific offering.

Nov. 20 2020, Updated 3:55 p.m. ET

Salesforce launches Financial Services Cloud

On August 25, 2015, Salesforce (CRM), along with the announcement of its Lightning platform for its Sales Cloud, launched Financial Services Cloud, its first industry-specific offering.

Wealth management firms like AIG Advisor Group, United Capital, and Northern Trust (NTRS) provided design inputs while Accenture (ACN), Deloitte Digital, PwC, and Silverline provided the technical integration to Salesforce Financial Services Cloud. Advisor Software, Informatica, and Yodlee are the independent software vendors that provided specific specialist tools to the Salesforce offering.

With its vertical-specific offering, Salesforce aims to provide a way to the financial advisers to closely knit programs together, such as those that involve rebalancing of clients’ investment portfolios or updates on their financial goals.

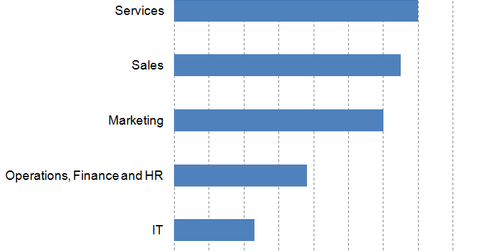

According to Bluewolf Consulting, a business consulting firm’s report on Salesforce.com and as the chart above shows, 70% of service leaders are measured on increasing customer engagement. Also, 60% of employees look to customer engagement as their top priority.

Salesforce seeks diversification to enhance revenue growth

In the past, we saw Salesforce expand from sales to cloud-based analytics. Through its Wave platform, Salesforce targeted entry into the business intelligence market. It provided clients with predictive analytics features by integrating its own customer relationship cloud offering. Plus, Oracle (ORCL) launched Oracle RightNow Analytics Cloud in September 2014. IBM (IBM) also released the beta version of Watson Analytics around the same time.

With Salesforce Financial Services Cloud, Salesforce has taken its first step to target high-value industries. This can be viewed as a positive step, as diversification ensures the expansion of horizons as well as the potential to earn revenues from diverse markets.

You can consider investing in the Technology Select Sector SPDR ETF (XLK) to gain exposure to Salesforce. XLK invests about 1.07% of its holdings in Salesforce.