Meraki Drives Cisco’s Commercial Segment Growth in 4Q15

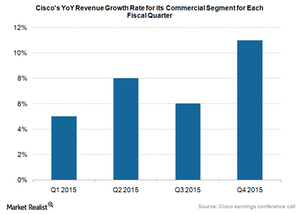

Cisco credits Meraki for the acceleration in revenue growth for Cisco’s commercial segment. Cisco’s year-over-year revenue growth for this segment rose to 11% in 4Q15.

Sept. 14 2015, Updated 9:06 a.m. ET

Meraki drives growth for Cisco’s commercial segment

Cisco Systems (CSCO) acquired Meraki in November 2012 for $1.2 billion. Meraki’s technology provides a way to control Wi-Fi networks through the cloud. During the fiscal 4Q15 earnings conference call, Cisco’s management said that Meraki customers have started to adopt Cisco’s cloud-based service at a fast rate. Management also mentioned that it closed fiscal 2015 with a $1 billion order run rate, up from a $100 million order run rate in 2012 when it bought Meraki.

Cisco also mentioned that Meraki is responsible for the acceleration in revenue growth for Cisco’s commercial segment. As you can see in the above graph, Cisco’s year-over-year revenue growth for its commercial segment rose to 11% in 4Q15.

HP provides stiff competition for Cisco

The wireless market is becoming more competitive every day. A few months ago, Hewlett-Packard (HPQ) acquired Aruba Networks for $3 billion. Aruba makes Wi-Fi network systems for enterprises, hotels, and universities. According to a report from IDC (International Data Corporation), Cisco, Aruba, Ruckus Wireless (RKUS), Hewlett-Packard, and Ubiquiti Networks (UBNT) are the top five players in the enterprise wireless local area network market. However, after acquiring Aruba, Hewlett-Packard has become an important player in the enterprise wireless network market, thereby increasing competition with Cisco.

If you’re bullish about Cisco, you can invest in the PowerShares QQQ Trust, Series 1 ETF (QQQ). QQQ invests about 2.7% of its holdings in Cisco.