How Did the Fidelity China Region Fund Class C Perform in August?

The Fidelity China Region Fund Class C (FHKCX) aims to achieve long-term capital growth.

Nov. 20 2020, Updated 3:12 p.m. ET

Investment objective and strategy

The Fidelity China Region Fund Class C (FHKCX) aims to achieve long-term capital growth. In order to achieve this objective, it invests at least 80% of its assets in securities from Hong Kong, Taiwan, and China issuers and other investments that are tied economically to the China region.

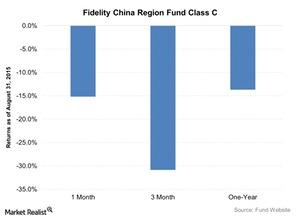

Performance evaluation

The FHKCX fell 15.2% in August 2015 from a month ago. In the three-month period ended August 31, the fund has fallen 30.9%. Meanwhile, in the one-year period, the fund is down by 13.7%. Most of the stocks were down during the Chinese stock market meltdown, which dragged down the monthly and quarterly performance of the FHKCX.

The fund has a Sharpe Ratio of 0.45 with a standard deviation of 19.2% as of August 31, 2015. Now, let’s look at its sectoral allocation.

Sector allocation and holdings

The financials sector dominates the FHKCX with a 36.6% weight. The consumer discretionary makes up 14.7% of the portfolio, closely followed by industrials with a 14.6% weight. The information technology sector commands a 12.4% weight. As you can see, the fund is heavily invested in these sectors, which are not performing well, largely due to the stock market crash, weak demand for luxury goods, and a decline in manufacturing activity. Thus, the fund’s overall performance has been adversely impacted.

FHKCX holds 124 stocks. Its top ten holdings account for 26.7% of the portfolio. Tencent Holdings (TCEHY) and Bank of China (BACHY) are included in the top ten holdings list. It also invests in the American depository receipts (or ADRs) of 58.com (WUBA), Alibaba Group Holdings (BABA), and Youku Tudou (YOKU).

Fund facts

The FHKCX has net assets of $1.26 billion as of August 31, 2015. The fund has an expense ratio of 2.07%. The fund mainly invests in large-cap growth and value stocks. The fund has been managed by Robert Bao since October 1, 2011. The fund was initiated on November 1, 1995.