58.com Inc

Latest 58.com Inc News and Updates

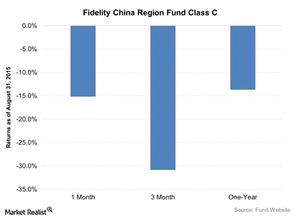

How Did the Fidelity China Region Fund Class C Perform in August?

The Fidelity China Region Fund Class C (FHKCX) aims to achieve long-term capital growth.

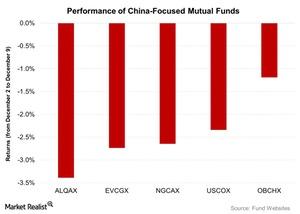

SSE Composite Index Falls despite China’s New IPO System

The SSE Composite Index fell by 1.8% from December 2 to December 9 and closed at 3,472.44 on December 9, 2015.

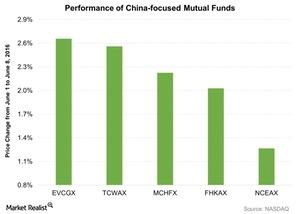

SSE Composite Index Rose ahead of Long Weekend

The SSE Composite Index rose slightly by 0.4% to 2,927.16 from June 1 to June 8, 2016, as the market prepared for the long weekend.

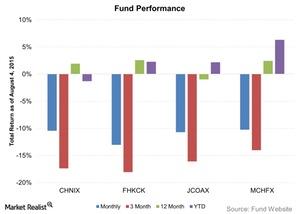

How Have China-Focused Mutual Funds Performed?

In the one-month period ended August 4, 2015, each of the four funds we’re covering in this series posted negative returns due to the stock market crash that spread from the end of June until July.