Dalio: Japan Is Undergoing an ‘Ugly Deflationary Deleveraging’

“Deleveraging” refers to reducing the debt level. With Japan’s debt burden, deleveraging the economy’s balance sheet seems more than imperative.

Nov. 20 2020, Updated 1:59 p.m. ET

Japan in an ugly deleveraging process

In his paper released in February 2012, providing An In-Depth Look at Deleveragings, Ray Dalio—the founder of the $160 billion hedge fund, Bridgewater Associates—discussed that Japan is undergoing an “ugly deflationary deleveraging” process.

In its most simplistic form, “deleveraging” refers to reducing the debt level. With Japan’s debt burden, deleveraging the economy’s balance sheet seems more than imperative. Although the government has been trying to reduce the leverage in the economy, it hasn’t had of an impact yet.

Japan has been monetizing

Japan has been monetizing its debt. A huge chunk of the economy’s total debt is held by the Japanese government. The Bank of Japan issues debt to the government. This has led to two things:

- The amount of debt, principal amount, flows into the economy in the form of increased government spending. This increases the money supply.

- The interest payments on the debt are payable to the Bank of Japan. This adds to the economy’s net gain.

Deleveraging hasn’t worked well with Japan

According to Dalio, an “ugly deflationary deleveraging” encompasses an economy. It’s in a bad state along with a rising debt-to-income ratio. This fits into what Japan (EWJ) (DXJ) is facing. For over 25 years now, the authorities in Japan have been trying to deleverage the economy. As part of the deleveraging process, monetary authorities in Japan printed money in an attempt to spur credit growth, spending, incomes, and growth. The money printing did help devalue the currency—the yen. In turn, this helped Japanese exporters like Sony (SNE), Toyota (TM), and Honda (HMC).

However, the nominal debt levels have been rising. The nominal income growth has largely been stagnant in the economy. The growth rates remain unstable, debt continues to pile up, inflation refuses to rise—despite the nose diving yen, and the deleveraging process isn’t bearing any fruit.

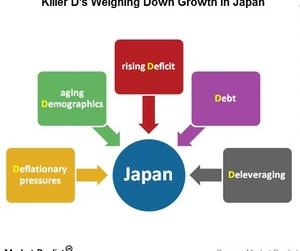

John Mauldin’s “Killer D’s”

John Mauldin also provides an informative analysis that can be applied to Japan. In one of his works, he talks about the “Killer D’s.” This includes debt, deficits, demographics, deleveraging, and deflation. All five of these can be closely associated with Japan.

Read Ray (Dalio) of Hope for Bond Investors or (Bill) Gross Delay in Raising Rates? to learn more.

For our latest analysis on Japan, visit Market Realist’s " href="https:\/\/marketrealist\.com\/t/ewj/" target="_blank">iShares MSCI Japan Index ETF (EWJ) page.