The Hows and Whys of Nucor’s Recent Falling Revenues

Nucor’s net revenues fell ~18% in 2Q15, compared to the corresponding quarter last year. Most steel companies have reported lesser revenues in 2Q15 as well.

Sept. 18 2015, Published 12:22 p.m. ET

Nucor’s revenues

Nucor Corporation (NUE), the largest steel company in the US, reports its revenues under three segments:

- Steel Mills

- Steel Products

- Raw Materials

Nucor has an integrated business model. Its Raw Material Segment supplies processed steel scrap and DRI (direct-reduced iron) to the Steel Mills segment. Meanwhile, the Steel Mills segment supplies raw steel to the Steel Products segment. The Steel Mills segment then further fabricates the steel. In this part, we’ll explore the 2Q15 financial performance of these segments.

Nucor’s revenues are falling

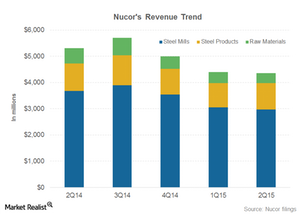

Nucor’s net revenues fell ~18% in 2Q15, compared to the corresponding quarter last year. This can be seen in the graph above. Below are a few noteworthy components of this decline:

- The external revenues of Nucor’s Steel Mills segment fell by almost 19%, compared to 2Q14. Steel Mills’ contribution to Nucor’s consolidated revenues came down more than one percentage point in 2Q15, compared to the last year.

- The company’s Steel Products segment reported a 4% fall in revenues in 2Q15, compared to the corresponding quarter last year. This segment contributed ~23% of Nucor’s 2Q15 total revenues, compared to 19.8% in the corresponding quarter last year.

- The 2Q15 external revenues of the company’s Raw Material segment fell by 36% year-over-year. The Raw Material segment contributed 8.5% to Nucor’s consolidated 2Q15 revenues, compared to the segment’s contribution of 10.9% in 2Q14.

Most steel companies have reported lesser revenues in 2Q15, compared to the last year. Steel Dynamics’ (STLD) 2Q15 revenues fell by more than 3%, while the U.S. Steel Corporation’s (X) net revenues came down by ~34% on a YoY (year-over-year) basis.

However, AK Steel Holding Corporation’s (AKS) net revenues rose by more than 10% YoY in 2Q15. This increase in revenues is largely due to AK Steel’s acquisition of the Dearborn plant last year.

Currently, AK Steel makes up 3.14% of the SPDR S&P Metals and Mining ETF (XME).

In the coming parts of this series, we’ll explore the key drivers of Nucor’s business segments. We’ll also see how the drivers are currently playing out, which should help us better understand how these segments could fare in 3Q15.