HACK Sees $1.17 Billion in Fund Inflows in Trailing Twelve Month Period

Overview of HACK The Purefunds ISE Cyber Security ETF (HACK) tracks a market-cap weighted portfolio of U.S. cyber security companies. This ETF tracks the performance of 34 publicly listed companies in the US cyber security sector. The market capitalization of the HACK is $1.08 billion with an expense ratio of 0.75% and average daily volume […]

Dec. 10 2015, Published 5:17 p.m. ET

Overview of HACK

The Purefunds ISE Cyber Security ETF (HACK) tracks a market-cap weighted portfolio of U.S. cyber security companies. This ETF tracks the performance of 34 publicly listed companies in the US cyber security sector. The market capitalization of the HACK is $1.08 billion with an expense ratio of 0.75% and average daily volume of shares (in $) traded is $9.98 million. The price/earnings ratio of HACK is 345.41x whereas its price/book ratio stands at 5.41x

The top holdings of the ETF include Cisco (CSCO) (4.01%), ProofPoint (PFPT) (4.37%), CyberArk (CYBR) (4.05%),Qualys (QLYS) (4.19%) and Juniper Networks (JNPR) (4.57%) that comprises over 22% of the total portfolio. Proofpoint also comprises 0.10 of the iShares Russell 2000 ETF (IWM).

Fund flows in HACK

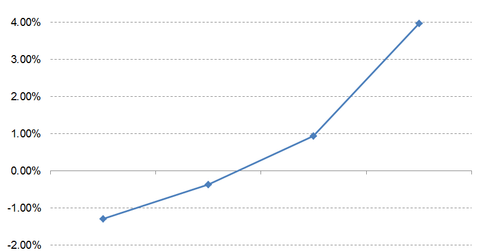

In the trailing one-month fund outflows for The Purefunds ISE Cyber Security ETF (HACK) has been -$34.84 million whereas in the trailing twelve months net fund inflows stand at $1.17 billion. Fund flows in the trailing 5 days and trailing three months (quarterly) for HACK is -$8.06 million and -$55.33 million. Since August 3, 2015, HACK is trading consistently below its moving averages and since then fund outflows in the ETF has been -$143.09 million.

HACK generated investor returns of 4% in the trailing twelve months and -1.3% in the trailing one-month period. In comparison, it generated returns of 1% YTD (year to date) and -0.37% in the last 3 months. We can see that fund flows are directly related to ETF returns.

Moving averages

On December 9, 2015, HACK closed the trading day at $26.16. Based on this figure, here’s how the stock fares in terms of its moving averages:

- 5% below its 100-day moving average of $27.43

- 1% below its 50-day moving average of $26.5

- 2% below its 20-day moving average of $26.73