Dyax Traded above Its 100-Day Moving Average

Dyax (DYAX) gained 9.41% last week. The stock went up after Dyax presented at the Morgan Stanley global healthcare conference, which took place September 16-18 in New York.

Sept. 28 2015, Updated 9:07 a.m. ET

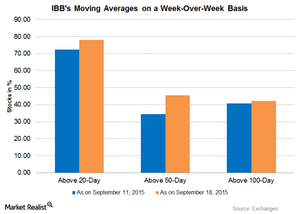

42.07% of IBB’s portfolio traded above 100-day moving averages

The iShares Nasdaq Biotechnology ETF (IBB) has 145 stocks in its portfolio. As of September 18, 2015, 77.93% of the stocks are trading above their 20-day moving average, 45.52% of the stocks are trading above their 50-day moving average, and 42.07% of the stocks are trading above their 100-day moving average. For the previous week ended September 11, 2015, 72.41%, 34.48%, and 40.69% of the stocks were trading above these averages.

The above graph reflects the percentage of stocks that are trading above 20-day, 50-day, and 100-day moving averages on a week-over-week basis. Out of 145 stocks, 113 stocks are trading above 20-day moving averages, 66 stocks are trading above 50-day moving averages, and 61 stocks are trading above 100-day moving averages. For the previous week ended September 11, 2015, the numbers were 105, 50, and 59, respectively.

Dyax trades above 100-day moving average

Dyax (DYAX) gained 9.41% last week. The stock went up after Dyax presented at the Morgan Stanley global healthcare conference, which took place September 16-18 in New York. The investors were positive and the stock went up on a high trading volume for the week ending September 18, 2015. Dyax closed at $24.99 as on September 18, 2015, and was trading above its 20-day, 50-day, and 100-day moving averages.

Acadia Pharma (ACAD) gained 3.93% and was trading above 20-day, 50-day, and 100-day moving averages. The stock closed at $43.33 as of closing on September 18, 2015. The stock went up on good trading volumes. The five-day average trading volume was at ~1.12 million shares per day.

Some other stocks that are trading above 20-day, 50-day, and 100-day moving averages are Clovis Oncology (CLVS), Qiagen NV (QGEN), and Regeneron (REGN) with a gain of 9.88%, 3.07%, and 3.20%, respectively.