Qiagen NV

Latest Qiagen NV News and Updates

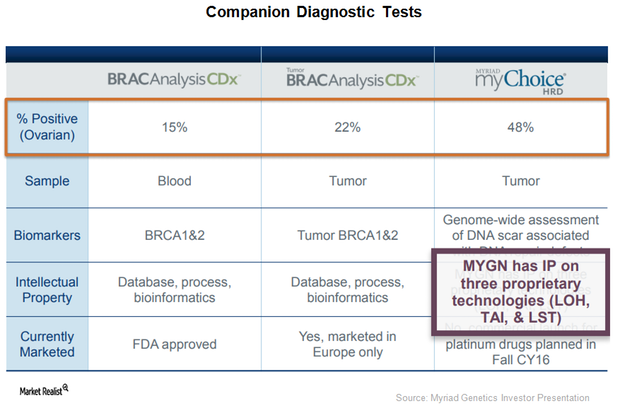

BRACAnalysis CDx Received FDA Approval for Ovarian Cancer Indication

On March 27, 2017, the FDA also approved BRACAnalysis CDX test as a complementary diagnostic test to be used with ovarian cancer maintenance therapy Tesaro’s (TSRO) Zejula (miraparib).

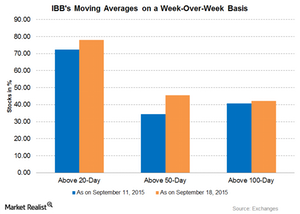

Dyax Traded above Its 100-Day Moving Average

Dyax (DYAX) gained 9.41% last week. The stock went up after Dyax presented at the Morgan Stanley global healthcare conference, which took place September 16-18 in New York.