Colgate’s Efforts to Generate Savings to Fund Growth

Colgate’s funding-the-growth technique is the key component of the company’s financial strategy, according to comments by Ian Cook, the company’s CEO.

Sept. 25 2015, Updated 12:07 p.m. ET

Overview

Colgate-Palmolive (CL) is a multinational, fast-moving consumer goods (or FMCG) company. Like peers Procter & Gamble (PG), Unilever (UL), and Clorox (CLX), Colgate also aims to generate savings for growth. Colgate’s funding-the-growth technique is the key component of the company’s financial strategy, according to comments by Ian Cook, the company’s CEO.

The funding-the-growth initiative was designed to reduce costs associated with direct materials, indirect expenses, and distribution and logistics. The company expects savings to be in the range of ~$0.34 billion–$0.40 billion by 2016.

Improving inventory

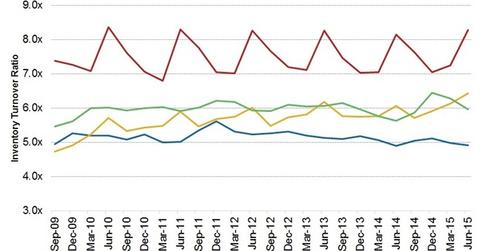

Colgate (CL) focuses on the reduction and efficient use of inventory. Colgate’s 2Q15 inventory turnover metric was stable at 4.9x. Colgate uses intermodal advanced modeling software, which is more direct, secure, efficient, and cheaper to use.

In addition, the company optimizes its warehouse locations in order to serve customers better. For example, the company reduced its physical inventory in Russia by 4%, according to Cook. This not only helps in reaching consumers faster, but it also increases brand penetration.

Peer comparison

In comparison, PG’s and CLX’s inventory turnover metric was reported at 6.4x and 8.3x, respectively, for 4Q15. Kimberly-Clark’s (KMB) inventory turnover for 2Q15 was ~6.0x.

According to Kantar’s Brand Footprint report, Colgate’s penetration rate was over 64%, implying it was reaching more than half the world’s households. This was the highest among all of the consumer packaged goods brands that were surveyed.

Global facilities

Under the company’s global growth and efficiency program, Colgate (CL) plans to combine its country operations by creating hubs in order to strengthen its ability to be a leading oral care firm. This should help Colgate’s offices to perform regional and global services and make Colgate products available around the world. The company has already established such facilities in Poland, Mexico, and India.

CL has exposure in the SPDR S&P 500 ETF (SPY) with 0.3% of the total weight of the portfolio.