Analyzing China’s Leading Economic Index

China’s Leading Economic Index currently indicates that the country’s economy is facing a downturn. Its LEI remained unchanged at 98.71 points in July 2015.

Nov. 20 2020, Updated 5:24 p.m. ET

Overview of the Chinese economy

China is predominantly a manufacturing and export-oriented economy. It dominates the global manufacturing of items like apparel, shoes, and electronic goods. Recently, the country’s exports have been slipping as a result of weak global demand and a volatile financial and business environment.

With this background, let’s explore China’s leading economic indicator to get a sense of the country’s outlook.

China’s Leading Economic Index

The Leading Economic Index (or LEI) is used to forecast future economic trends. China’s leading economic index currently indicates that the country’s economy is facing a downturn.

According to China’s National Bureau of Statistics, the country’s LEI remained unchanged at 98.71 points in July 2015 from 98.71 points in June 2015.

This figure differs slightly from Conference Board estimates. The Conference Board is a global, independent business membership and research association that publishes leading and composite economic indexes for various countries. The Conference Board’s LEI for China increased 0.9% in July to 331.2, following a 0.6% increase in June 2015. The rise in July’s LEI was driven mainly by bank loans. But overall, consumer sentiment, manufacturing, and exports were weak.

Sluggish GDP growth and weak exports

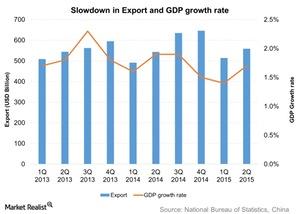

Exports are suffering from subdued global demand. Although exports have ticked upward in the last couple of months, a further uptick looks challenging due to economic slowdowns for China’s major trading partners, including South Korea and Taiwan.

Growth in China’s economy has been robust, but it slowed to a 7.4% pace in 2014 from 7.7% in 2013. A 7.4% growth rate is China’s slowest growth rate over the past 24 years. The government is aiming for 7% GDP (gross domestic product) growth in 2015. This downwardly revised aim is primarily due to waning global demand for Chinese exports.

Government efforts to prop up the economy

The People’s Bank of China (or PBoC) cut its benchmark lending rate by 25 basis points to 4.6% on August 25, 2015, its fifth rate cut since November 2014. It also cut banks’ reserve requirement ratio by 0.5%. This move was intended to maintain adequate liquidity in the system and boost exports, thus helping a slowing economy.

Companies like Tencent Holdings (TCEHY), Ping An Insurance Company of China (PNGAY), China Mobile (CHL), and Taiwan Semiconductor Manufacturing (TSM), which are large exporters, would most likely benefit from an export revenue increase as the yuan decreases in value.

China requires further liberalization measures

China’s central bank and regulatory authorities have used interest rate cuts and an improvement in bank lending as tools to boost economic activity.

However, China’s economy requires further liberalization in the financial markets, such as foreign ownership or foreign participation in Chinese financial institutions. Rate cuts alone will most likely not cure the economic situation.

After considering China’s economy in this part of our series, we’ll dive into the world of China-focused mutual funds in Part 2. We’ll examine the Clough China I Fund (CHNIX), the Fidelity China Region Fund (FHKCX), the John Hancock Greater China Opportunities Fund (JCOAX), and the Matthews China Investor Fund (MCHFX).