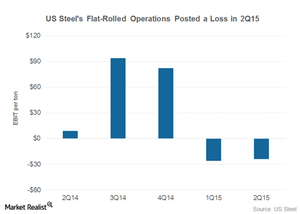

U.S. Steel’s Flat Rolled Segment Posts a Loss in 2Q15

U.S. Steel’s Flat-Rolled segment posted negative EBIT of $24 per ton in 2Q15. This represents a slight improvement over 1Q15 results.

Aug. 11 2015, Updated 4:05 p.m. ET

U.S. Steel Corporation’s North American Flat-Rolled segment

Previously in this series, we looked at U.S. Steel Corporation’s (X) consolidated 2Q15 results. In this part, we’ll explore how U.S. Steel’s North American Flat-Rolled segment fared in 2Q15.

The flat rolled segment is U.S. Steel’s biggest segment in terms of revenue. It’s come under pressure as spot carbon steel prices have plummeted over the last nine months.

Currently U.S. Steel forms 4.55% of the SPDR S&P Metals and Mining ETF (XME) and 0.18% of the SPDR S&P MidCap 400 ETF (MDY).

U.S. Steel’s flat rolled segment posts a loss in 2Q15

U.S. Steel’s flat rolled segment posted negative EBIT (earnings before interest and taxes) of $24 per ton in 2Q15. This represents a slight improvement over 1Q15, during which U.S. Steel’s flat rolled segment posted a loss of $26 per ton.

Almost all steel companies, including Nucor (NUE) and Steel Dynamics (STLD), reported lower per-ton profits in 2Q15 as compared to 1Q15. The common theme during these companies’ earnings conference calls has been that falling steel prices have more than offset the benefits of lower input prices.

You can read more on the recent trend in steel and steelmaking raw material prices in our monthly steel indicator series.

Carnegie Way program

U.S. Steel’s North American Flat-Rolled segment was able to more than offset lower steel prices by way of aggressive cost cutting. U.S. Steel is taking several measures to cut costs. Structural costs are the target of its Carnegie Way program.

U.S. Steel has also rationalized its workforce in tandem with reduced steel demand. We’ll discuss U.S. Steel’s cost-cutting measures further in the coming parts of the series. But in the next part, we’ll explore U.S. Steel’s Tubular segment’s 2Q15 financial performance.