Macroeconomic Factors Affecting Investment-Grade Bond Yields

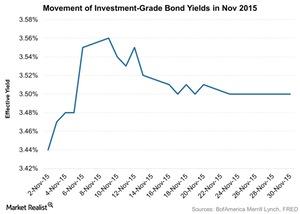

Investment-grade bond yields rose 8 basis points month-over-month and ended at 3.5% on November 30 due to high expectations of an interest rate hike in the December policy meeting.

Dec. 29 2015, Updated 11:31 a.m. ET

Investment-grade bond yields

Investment-grade bond yields rose eight basis points month-over-month and ended at 3.5% on November 30 due to high expectations of an interest rate hike in the December policy meeting. Later, the Fed did raise the federal funds rate 25 basis points on December 16.

Indicators that impacted yields

Non-farm payrolls increased by 271,000 in October from 137,000 in September—the largest rise since December 2014. This indicates that the US job market is improving. As a result, investment-grade bond yields rose.

The CPI (consumer price index) rose 0.2% YoY (year-over-year) in October, which supported the Federal Reserve’s rate hike decision. The Core PCE (personal consumption expenditure) index remained unchanged at 1.3% quarter-over-quarter. The Federal Reserve prefers to use the PCE (personal consumption expenditure) index over the CPI to guide its decisions, as the PCE index is updated more often and takes other factors into account such as employer expenditures on healthcare and substitution between goods. The CPI is based on what people say they’re buying and is not updated often. Meanwhile, the US economy’s growth in 3Q15 was revised to 2.1% from the 1.5% originally reported.

Impact on mutual funds

The Vanguard Total Bond Market Index Fund Investor Shares (VBMFX) provides broad exposure to US investment-grade bonds. The VBMFX invests in investment-grade corporate bonds of companies such as Apple (AAPL), Walmart (WMT), Bank of America (BAC), AT&T (T), and Oracle Corporation (ORCL).

The monthly return (from October 30 to November 30) of VBMFX was -0.18%.

We’ll look at investment-grade corporate debt issuances for November later in this series. First, let’s take a look at how yields and spreads on corporate bonds have fared in 2015.