Technology: The Driving Force behind Domino’s Pizza

Domino’s continues its investment in the technology space with its recent launch of Domino’s pizza delivery tracker available on Apple Watch.

July 17 2015, Updated 9:07 a.m. ET

Technology update

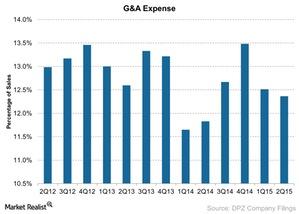

Domino’s Pizza (DPZ) continues its investment in the technology space with a recent launch of its pizza delivery tracker available on Apple Watch. This joins the company’s existing online tracker, a voice ordering facility called Dom, the ability to order pizza using a pizza emoji, and via Twitter. About 50% of the orders in the US come through the digital channel. These expenses are part of the G&A (general and administrative) expenses.

During the 2Q15 earnings call, Domino’s management stated that 25% comes from mobile and another 25% comes from online orders. Company management stated that it will continue to make these long-term investments as needed. However, digital channel sales seem to be stuck at the 50% level. This will be an important metric to watch during coming quarters, as a way to assess the success of the company’s tech investments.

Technology fees

Domino’s Pizza collects a fee of ~$0.17 per order from its franchise for these technology-driven initiatives. During 2Q15, the company increased this fee to $0.21, which would bring in about $1 million in revenue, or ~$190,000 incrementally. This fee went into effect in March and was included in the 2Q15 financial results.

Domino’s is also testing a new loyalty program. If this turns out as strong as Starbucks’ (SBUX) loyalty program, Domino’s should be able to bring in additional customers and boost its same-store sales growth. Papa John’s (PZZA) also has a loyalty program in which customers earn one point every $5 spent. These points can be redeemed when ordering.

Currently SBUX forms 3% of the Consumer Discretionary Select Sector ETF (XLY). XLY also holds about 1.5% of Pizza Hut’s parent Yum! Brands (YUM).

In the next part, we will wrap up this series with other key highlights and a company outlook.