What Drives Procter & Gamble’s Growth?

The emerging markets of Asia, Eastern Europe, and Latin America offer ample growth opportunities for the consumer staples sector.

July 14 2015, Updated 11:06 a.m. ET

Continued growth via successful innovations

The Procter & Gamble Company, or P&G (PG), is a global leader in the FMCG (fast-moving consumer goods) industry. It provides branded goods of superior quality and value to its customers around the world. P&G’s business model relies on the continued growth and success of existing brands and products, as well as the creation of new products and innovation in existing brands.

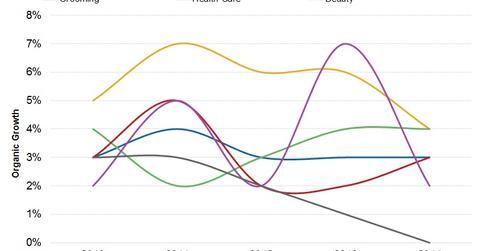

The above chart gives an overall organic growth history of P&G and its five segments.

Consumer demand and low elasticity

The consumer is king. Rising populations, changing consumer behaviour, trends, and habits have led to growth in the consumer staples sector (XLP). Rising household incomes have not only affected the willingness of consumers to spend on prestigious brands but have also led to a highly competitive global market.

Consumer spending cycles tend to swing with the economy. But the consumer staples sector tends to move in a more structured pattern. Staples tend to have low price elasticity of demand. This means that the demand for these products doesn’t change so much as their prices go up or down. Yet there are plenty of substitutes for the products themselves.

Indeed, P&G operates in a highly competitive environment. Peers Unilever (UL), Kimberly-Clark (KMB), and Colgate-Palmolive (CL) have thrived by adopting new technologies and processes and by adding innovative products and brands in both developed and developing markets.

There are also many options to shop for lower prices among suppliers. This gives staples suppliers little room to raise prices or increase demand for their products.

Rising prices

Rising commodity costs and currency fluctuations have negatively affected the company’s margins recently. P&G manages these cost pressures through right-pricing actions, hedging currency risks, as well as by improving productivity.

The emerging markets of Asia, Eastern Europe, and Latin America offer ample growth opportunities for the consumer staples sector.

The iShares Core S&P 500 ETF (IVV) and the SPDR S&P 500 ETF (SPY) each provide ~1.2%[1. All ETF portfolio weights are as of June 27, 2015] exposure to P&G.