What Are the Drivers Affecting Procter & Gamble’s Profitability?

Last August, P&G announced it was working on exit options for ~100 brands to improve sales and profitability. All of the brands contributing little to growth will be disposed of.

July 16 2015, Updated 11:05 a.m. ET

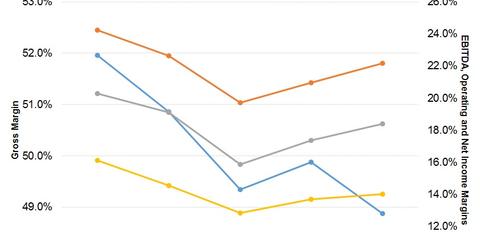

Margins overview

The Procter & Gamble Company’s, or P&G’s (PG), gross margin contracted in fiscal 2014 when compared with fiscal 2013. This was due to unfavorable geographic and product mix, higher commodity costs, and foreign exchange fluctuations.

The company reported 0.6% revenue growth for fiscal 2014, supported by 3% growth in volumes.

In 2014, Colgate-Palmolive (CL) outperformed P&G by a significant margin. It achieved organic non-GAAP[1. Non-GAAP is a measure that excludes the impact of acquisitions, divestitures, and foreign exchange] revenue growth of 6% year-over-year. In comparison, P&G’s organic revenue growth rate was 3%.

The chart above shows P&G’s gross margins as well as EBITDA (earnings before interest, taxes, depreciation, and amortization), operating, and net income margins.

P&G’s focus on efficient marketing

P&G’s profitability expanded in fiscal 2014 due to a smaller increase in SG&A (selling, general, and administration) expenses as compared to net sales. The effective tax rate was also lower. These factors were partially offset by the higher cost of goods sold, or COGS. Higher commodity prices mainly affected COGS.

Unilever (UL) and Kimberly-Clark (KMB) invest in marketing spending much the way P&G does. UL and KMB spent ~$8.6 billion and ~$3.7 billion, respectively, on marketing and research in fiscal 2014.

Spending less on marketing in fiscal 2014 allowed P&G to increase net earnings. The company is focused on efficient marketing for promising products in all territories. For example, it promotes innovations and core competencies related to its profitable brands Tide, Pampers, Crest, Olay, and Pantene.

Profitability margins

Last August, P&G announced it was working on exit options for ~100 brands to improve sales and profitability. All of the brands contributing little to growth will be disposed of. For this reason, some of P&G’s beauty segment brands were divested at an auction. To learn more, read Coty Wins 3 Auctions for P&G Beauty Brands: A Win-Win Deal?

Aside from focusing on core businesses and improving execution, P&G is ramping up productivity and cost-saving efforts. Innovation and productivity are the biggest drivers of value creation and growth at P&G. The firm’s organic revenue increased by 3% in fiscal 2014. Research and product development activities, designed to enable sustained organic growth, continue to be a high priority.

P&G makes up ~1.2%[2. All ETF portfolio weights as of June 27, 2015] of the SPDR S&P 500 ETF Trust (SPY) and ~1.2% of the iShares Core S&P 500 ETF (IVV).