KKR’s Distribution Policy: A Reward for Unit Holders

KKR & Co. (KKR) paid a fixed dividend of $0.17 in May 2017 according to its policy announced in 2016.

May 22 2017, Updated 7:36 a.m. ET

Distribution to be made in 2Q17

KKR & Co. (KKR) paid a fixed dividend of $0.17 in May 2017 according to its policy announced in 2016. All holders of preferred units (Series A) are expected to receive a distribution of ~$0.42 per preferred unit on June 15, 2017.

According to KKR’s distribution policy, all holders of preferred units (Series B) are expected to receive ~$0.41 per preferred unit on June 15, 2017.

KKR has given higher distributions to its limited partners in the recent quarter on the back of improved operating performance of its holdings. However, these distributions may not continue in the upcoming quarters.

Any further distributions are left to the judgment of the board of directors of the general partner of KKR. The company’s lower distribution policy helps it retain more profits and helps shareholders make equity capital gains.

Issuance of unsecured notes

In March 2017, a private placement that was held by KKR Financial Holdings LLC, 5.500% Senior Unsecured Notes had been issued for a par amount of $375.0 million maturing on March 30, 2032. These unsecured notes can be redeemed only in whole after March 30, 2022.

In November 2016, the redemption of $258.8 million in 8.375% senior notes was implemented by KKR Financial Holdings LLC. In April 2017, a redemption of 7.500% Senior Notes was implemented. Through all these transactions, a redemption of $373.8 million in its outstanding debt obligations was implemented by KKR Financial Holdings LLC. This redemption resulted in $9.7 million in savings in future annual interest expenses.

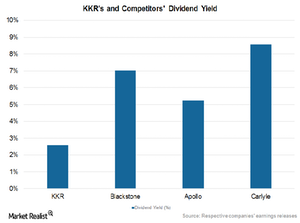

In December 2016, KKR’s competitors had the following returns on equity on a TTM (trailing-12-month) basis:

Apollo Global Management (APO), Carlyle Group (CG) and Blackstone Group (BX) together constitute 4.1% of the PowerShares Global Listed Private Equity ETF (PSP).