Disney Merges Disney Consumer Products and Disney Interactive

On June 29, Disney announced it will merge two of its stand-alone segments into one. Disney Consumer Products and Disney Interactive will become Disney Consumer Products and Interactive Media.

July 30 2015, Updated 11:05 a.m. ET

Disney merges two segments

On June 29, 2015, The Walt Disney Company (DIS) announced it will merge two of its stand-alone segments into one. Disney Consumer Products and Disney Interactive will become Disney Consumer Products and Interactive Media. Disney will report financial results for the newly combined segment in fiscal 2016, which begins in late September.

Disney Consumer Products generates revenue through licensing deals with third parties for its popular characters. Third parties are allowed to use the characters for merchandise, children’s books, magazines, and comic books. The products are sold as retail merchandise through stores and online shopping sites.

Disney Interactive develops and sells multi-platform games, subscriptions to online and mobile games, licensing content for Disney-branded mobile phones in Japan (EWJ), and online advertising and sponsorships.

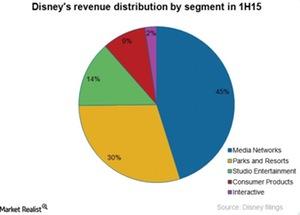

As you can see in the above graph, Disney Consumer Products and Disney Interactive together made up ~11% of Disney’s total revenues of $25.8 billion in 1H15. The two segments together had revenues of ~$2.9 billion in the first half of fiscal 2015.

Overlapping segments

There’s a growing overlap between Disney Consumer Products and Disney Interactive. Disney Consumer Products is increasingly developing toys that embrace digital technology. This includes application-based storybooks such as Star Wars Journeys and mobile learning apps (applications) like Imagicademy and Playmation that use wireless systems and motion sensors. They will be unveiled later this year.

Disney Interactive, which had been battling losses, turned profitable in the last fiscal year due to a good response to its console game Disney Infinity, a game that leverages the company’s intellectual property. For example, when the movie Frozen was released in theaters, Disney Interactive released a Disney Infinity collectible figure of the Frozen princess. When the figure was plugged into the Disney Infinity base, it unlocked video game adventures.

The Disney Interactive segment is facing tough competition from Activision Blizzard’s (ATVI) popular Skylanders game, Nintendo’s (NTDOY) Amiibo game, and Electronic Arts’ (EA) console games.

You can get a diversified exposure to Disney by investing in the Consumer Discretionary Select Sector SPDR ETF (XLY), which holds 7.63% of the stock.