What Does Facebook’s High Price-to-Earnings Ratio in May Tell Us?

In May 2012, Facebook’s stock price was $38, and its PE ratio was 80.0 x. The ratio reached an all-time high of 7,930x, when net income dropped to $53 million that year.

June 10 2015, Updated 11:06 a.m. ET

About Facebook

Facebook is a social networking channel. It had 1.39 billion users and 890 million daily active users worldwide as of December 2014. The company generates substantial revenue from advertising and fees associated with the Facebook Payments infrastructure. This enables Facebook users to purchase virtual and digital goods from developers.

In 2014, Facebook acquired WhatsApp Messenger and Oculus VR to improve its next generation of communication and computing platforms.

Price-to-earnings ratio of peer companies

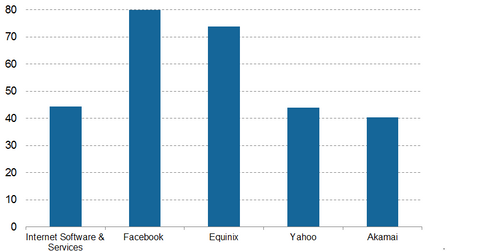

The overall price-to-earnings (or PE) ratio of the Internet Software & Services subsector of the Technology Select Sector SPDR ETF (XLK) is 44.41x. Facebook’s (FB) PE ratio is significantly higher at 80.04x.

Other firms that are part of this subsector include Equinix (EQIX), Yahoo! (YHOO), and Akamai Technologies (AKAM). They have PE ratios of 73.97x, 43.88x, and 40.33x, respectively.

Facebook PE ratio decreases since 2012

In May 2012, Facebook was floated on NASDAQ with a stock price of $38 and had a PE ratio of approximately 80.0 x. This ratio reached an all-time high of 7930x when net income dropped to $53 million in 2012. Facebook then made regular improvements to its website and increased income through advertising revenue and mobile strategy, thereafter producing solid results.

The PE ratio decreased from 7930x, mainly due to growth in operating revenues and net income. The company’s EPS (earnings per share) also increased by 39.20% on a year-over-year basis in the trailing 12 months (or TTM).

Future outlook

Facebook’s total user base is currently 1.4 billion. That’s 20% of the world’s population. Exponential growth in user base seems unlikely. According to analysts, Facebook’s future growth will rely on marketing activities and increased user time. Facebook’s acquisitions, including WhatsApp Messenger, Instagram, and Messenger, will ensure that inorganic growth continues in the long term.

The next part of this series will cover the high PE ratio of Red Hat.