Key Investor Takeaways from US Steel’s 1Q Earnings Release

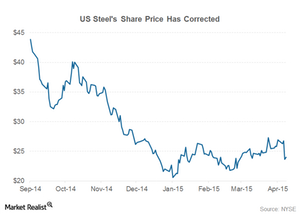

US Steel’s 1Q earnings results came in lower than analyst estimates, and the company’s share price tanked more than 10%.

May 1 2015, Published 1:44 p.m. ET

US Steel’s 1Q earnings

US Steel (X) released its 1Q earnings on April 28 after the markets closed. It posted an adjusted loss of $0.07 per share. US Steel’s results came in lower than analyst estimates, and its share price tanked more than 10%. AK Steel (AKS) also posted its results on the same day. Its share price rallied ~10% after its earnings release.

Nucor (NUE), which posted its 1Q earnings on April 23, increased 2% after the earnings release, as its earnings were better than street estimates, as well as its own guidance. The company currently forms 2.6% of the Materials Select Sector SPDR ETF (XLB).

What do we cover?

In this series, we’ll analyze the key investor takeaways from US Steel’s 1Q earnings. US Steel, the largest producer of tubular goods in North America, has been negatively impacted by the steep fall in crude oil prices. Its share price has been under pressure this year as the demand for tubular goods has come down. The previous chart shows the recent movement in US Steel’s share price.

Tenaris (TS) is another leading supplier to the energy sector. Its 1Q net income fell by almost half, as energy companies have scaled back their capital expenditure budgets for the current year.

Reporting segments

US Steel reports its financial results under its tubular and flat-rolled segments. The company also has operations in Europe, which are reported under a separate segment. Its flat-rolled segment produces hot-rolled, cold-rolled, and coated steel products. The segment also supplies raw material for US Steel’s tubular operations. In the next part, we’ll discuss how these segments contributed to US Steel’s 1Q earnings.