TJX Companies’ Best-in-Class Inventory Management

TJX Companies (TJX) has a very efficient internally developed inventory management system that helps the company ensure the proper flow of merchandise.

April 9 2015, Updated 1:38 p.m. ET

Inventory management

TJX Companies (TJX) has a very efficient internally developed inventory management system that helps the company ensure the proper flow of merchandise. The company’s distribution system and off-price business model guarantees high inventory turnover.

The SPDR S&P Retail ETF (XRT) allocates about ~1.0% of its portfolio holdings to TJX Companies.

High inventory turnover ratio

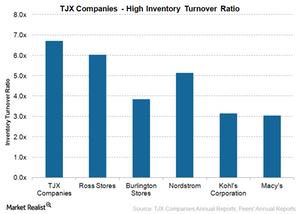

TJX Companies’ inventory turnover ratio of 6.7x is superior to its peers in the off-price space as well as in the department stores category.

Off-price retailers Ross Stores (ROST) and Burlington Stores (BURL) turn their inventory 6.0x and 3.8x times in a year, respectively. Nordstrom (JWN), which is rapidly growing in the off-price space through the Rack stores, has an inventory turnover ratio of 5.2x.

TJX Companies maintains lean inventory levels compared to department stores like Macy’s (M). This gives it the flexibility to make opportunistic purchases in contrast to department stores, which order most of their merchandise in advance.

The iShares Core S&P 500 ETF (IVV) has ~12.6% exposure to the consumer discretionary sector, which includes department stores and off-price retailers.

Continuous improvement

In fiscal 2015 ending January 31, 2015, TJX Companies continued to further improve its inventory management. The company turned its inventory ~6.7x compared to ~6.6x in fiscal 2014. Another key metric is the days inventory outstanding. This reflects the average number of days a company holds its inventory. In fiscal 2015, it dropped to 54.2 days compared to 55.5 days last year.

One of the key reasons for the company’s efficient inventory management is its strong relationship with suppliers, which we’ll look at in the next part of this series.