Analyzing Icahn Associates’ 13D and 4Q14 13F Filings

Icahn Associates’ 4Q14 positions were disclosed through a 13F filing in February. The size of the US long portfolio was down to $31.89 billion.

Nov. 20 2020, Updated 10:54 a.m. ET

Icahn’s latest 13D updates

Carl Icahn is one of Wall Street’s most influential investors. Since March, Icahn Associates made some changes to its existing positions through 13D filings. It raised its positions in Federal-Mogul Holdings (FDML) and Chesapeake Energy (CHK).

Icahn Associates’ holdings in the fourth quarter

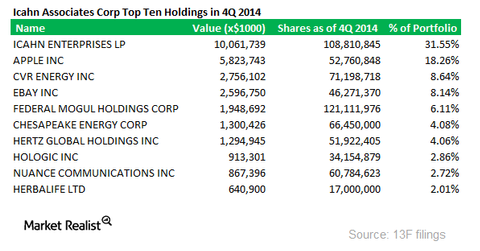

Icahn Associates’ 4Q14 positions were disclosed through a 13F filing in February. The size of the US long portfolio was down to $31.89 billion. It was $33.63 billion last quarter.

Notable position increases during the fourth quarter were made in Hertz Global Holdings (HTZ) and Navistar International (NAV).

The fund added a new position in Manitowoc Company (MTW). We’ll discussed this in detail in our series Must-know: Manitowoc to split after activist pressure.

The above chart outlines Icahn Associates’ main positions.

Icahn withdraws from proxy fight at Gannett

A 13D filing earlier in March over Gannett (GCI) revealed that Icahn Associates withdrew nominations for two directors to the company’s board. A Market Realist article in February highlighted Icahn’s activist stance on Gannett. The fund owns 6.63% stake in Gannett, according to previous filings. Under an agreement between Icahn and Gannett, the latter agreed to implement some corporate governance proposals at its publishing company—SpinCo. It will be spun off soon.

Icahn said that these proposals “will greatly enhance shareholder value.” Gannett has 0.31% exposure to the Consumer Discretionary Select Sector SPDR Fund (XLY).

Voltari shares surge after Icahn boosts stake

Another position increase through a 13D filing in March was Voltari (VLTC). Its shares surged on the news of the activist investor’s moves. Icahn raised its stake in the mobile advertising company to 4,739,620 shares—or 52.3% stake. The company has a $40 million market cap.

The next part of this series will highlight the fund’s 13D positions beginning with Chesapeake Energy.