Key Drivers Impacting Under Armour’s Future Financial Performance

The impact of adverse forex movements on UA’s financial performance may be mitigated somewhat by the stronger retail environment in Europe.

Nov. 20 2020, Updated 11:07 a.m. ET

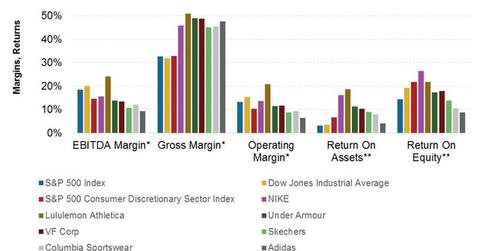

Under Armour’s operating profitability

Operating income growth is projected to trail revenue growth for Under Armour (UA) in 2015. Operating income growth is estimated at 12%–15% over 2014 levels, according to management guidance.

The company expects to incur one-time deal closure costs of $7 million. It also expects other operating costs estimated at $27 million relating to its connected fitness purchases in 1Q15 and 4Q14. The revenue upside provided from these acquisitions is expected to range between $25 million and $30 million in 2015.

Operating income for 2015 is expected to range from $397 million to $407 million after considering the impact of the connected fitness purchases.

Forex headwinds

Although UA derives more than 90% of its sales from North America, it warned of currency headwinds in its last earnings call in February. The US dollar has appreciated across most major currencies since the start of 2014.

Under Armour has a growing business in Europe, South America, and Asia, which is likely to bear the brunt of adverse forex movements. The depreciating Canadian dollar is also expected to negatively impact Under Armour’s earnings.

However, Under Armour (UA) and Lululemon Athletica (LULU) are expected to have a lower impact from currency movements than Nike (NKE) and VF Corporation (VFC). NKE derives ~56% of its sales from outside North America. VFC recorded ~38% of its sales from outside the United States.

The Eurozone impact

The impact of adverse forex movements on UA’s financial performance may be mitigated somewhat by the stronger retail environment in Europe. International sales for UA have already exhibited strong growth. Although their absolute value and contribution to the revenue pie is small, sales grew by more than 100% in 2014, including the impact of the US appreciating dollar.

The additional liquidity and lower interest rate environment brought about by the European Central Bank’s (or ECB’s) bond buying program is likely to positively impact consumption in the euro area, boosting the financial performance for consumer discretionary (XLY) companies. Consumption is also getting a boost in Europe due to the unexpected windfall from lower energy prices.

The world’s largest luxury goods company, Louis Vuitton Moët Hennessy (LVMUY) (MC.PA), reported a 16% increase in 1Q sales to 8.3 billion euros. Organic sales rose by 3% in constant currency terms.

The retail environment in the United Kingdom (EWU) has also improved. Retail sales have grown for five successive months and increased by 0.7% in February, according to the United Kingdom’s Office for National Statistics.

On the flip side, UA is currently incurring losses in its relatively nascent international operations due to investments made to grow the business. This factor may result in marginally lower operating margins, given the small contribution of UA’s international business.

For more sector analysis, visit Market Realist’s Consumer and Retail page.