A Look at Texas Instruments’ Strategy to Improve Profitability

Texas Instruments (TXN) has improved its revenue by diversifying into various end markets.

Nov. 20 2020, Updated 10:44 a.m. ET

Texas Instruments’ profitability

Texas Instruments (TXN) has improved its revenue by diversifying into various end markets. The company’s profits are a product of lower production costs and factory optimization.

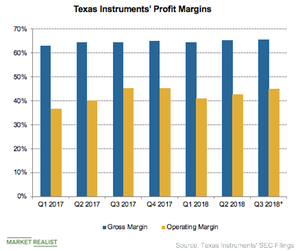

Gross margin

Texas Instruments improved its gross margin by 90 basis points YoY (year-over-year) to 65.2% in fiscal Q2 2018 by shifting more analog production to 300mm (millimeter) wafers. Its gross margin is lower than Maxim Integrated’s (MXIM) and Analog Devices’ (ADI) calendar Q1 2018 gross margins of 64.7% and 71.3%, respectively.

During Texas Instruments’ fiscal Q2 2018 earnings call, CFO Rafael Lizardi stated that the company still has room to improve its gross margin, as 300mm wafers have 125% more surface area than the 200mm wafers used by its competitors. Transitioning to 300mm wafers would its reduce per-chip production costs and improve its manufacturing efficiency. In 2017, it manufactured 40% of its analog output on 300mm wafers and plans to increase this percentage in future years.

Operating margin

Texas Instruments is also improving its operating efficiency. In fiscal Q2 2018, its operating expenses rose 2%, whereas its revenue rose 9%, resulting in a 16% YoY rise in operating income. This increase improved its operating margin from 40% in fiscal Q2 2017 to 42.6% in Q2 2018.

The analog division’s operating margin improved by 80 basis points YoY to 45.4% in fiscal Q2 2018 as more production moved to 300mm wafers, and the embedded division’s margin improved by 420 basis points to 35.4%. Texas Instruments’ operating margin is wider than Maxim’s and Analog Devices’ calendar Q1 2018 operating margins of 34.6% and 42%, respectively.

EPS

Texas Instruments’ EPS rose 36% YoY to $1.40, beating analysts’ estimate of $1.32. The EPS growth was driven by a discrete tax benefit of $0.03 per share, profit margin improvement, and stock buybacks. The company expects its fiscal Q3 2018 EPS to rise 20.6% YoY to $1.52, beating analysts’ estimate of $1.48. Next, we’ll look at the effects of Texas Instruments’ wide margins on its cash flow.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!