Yahoo Coins the Term MaVeNS, Its Key Revenue Growth Driver

In 2015, Yahoo’s management expects that MaVeNS will contribute more than $1.5 billion of revenue to Yahoo’s overall business.

Dec. 4 2020, Updated 10:53 a.m. ET

What is MaVeNS?

In a previous series on Yahoo (YHOO) called What you can expect from Yahoo’s 4Q14 earnings, we looked at Yahoo’s revenue growth. We saw how the growth was driven by investments in newer areas such as mobile, video, native, and social advertising.

During 4Q14, Yahoo’s declining revenue from core businesses was offset by increasing revenues from newer regions, the fastest growing areas of digital advertising. Yahoo completed dozens of acquisitions over the past two to three years. The acquisition of Flurry, BrightRoll, and Tumblr were mainly to boost its market share in mobile, video, and social space, respectively. Yahoo is looking for more opportunities to strengthen its lagging advertising sales.

Yahoo coined the name MaVeNS, a broad acronym for mobile, video, native, and social. Prior to 2012, Yahoo had no native or social ads, and mobile and video were in the nascent stage. The four MaVeNS businesses didn’t contribute any revenue. And now, within less than two years, MaVeNS has contributed more than $1 billion of annual revenue. In Q4 and full year 2014, these four businesses—mobile, video, native, social—together delivered strong revenue growth of 100% and 95%, respectively, on a year-over-year basis.

In 2015, Yahoo’s management expects that MaVeNS will contribute more than $1.5 billion of revenue to Yahoo’s overall business.

Competition in video ad market increasing

Similar to Yahoo, Facebook (FB) is also taking a lot of initiatives in the video ad and mobile spaces to boost its share in the market.

Google (GOOG) also launched its Google Preferred Video program. This is a program to promote the top 5% of the content on YouTube in areas such as food, music, and entertainment. Google also launched the Partner Select program. This is a programmatic premium video marketplace to help publishers monetize their video content. This program also helps ad agencies reach quality video content on the Internet. It’s basically an interface between publishers and ad agencies for video ads.

Despite increasing competition, Google continues to do well. The video ad market has been growing at a healthy rate over the past few years, and YouTube is the largest player in this market.

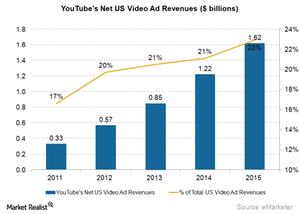

According to a report from eMarketer and as the chart above shows, YouTube generated about $1 billion in revenues in 2014 from video ads in the United States. Its share in the US video ad market was about 21%. eMarketer expects this market share to continue to increase slightly.

Facebook and Google together make up 10.3% of the PowerShares QQQ Trust, Series 1 ETF (QQQ) and 11.9% of the Technology Select Sector SPDR ETF (XLK). You can gain portfolio exposure to Facebook and Google by considering these ETFs.