Why McDonald’s Revenues Declined in 2017

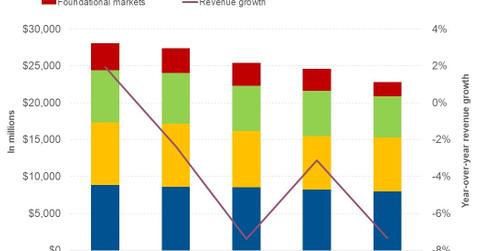

In 2017, McDonald’s (MCD) posted revenues of ~$22.8 billion, which represents a fall of 7.3% from ~$24.6 billion in 2016.

April 5 2018, Updated 7:35 a.m. ET

2017 performance

In 2017, McDonald’s (MCD) posted revenues of ~$22.8 billion, which represents a fall of 7.3% from ~$24.6 billion in 2016. The effects of the addition of new franchised restaurants and positive SSSG (same-store sales growth) were more than offset by the refranchising of company-owned restaurants, which led to a fall in the company’s stock price. The company’s revenues fell 2.4%, 7.4%, and 3.1% in 2014, 2015, and 2016, respectively.

The United States

The United States segment posted revenues of $8.0 billion in 2017, which represents a fall of 3.0% from ~$8.3 billion in 2016. Due to the refranchising and closing of underperforming company-owned restaurants, the segment operated 222 fewer restaurants by the end of 2017 than the unit count at the end of 2016. However, some of the declines were offset by a favorable SSSG of 3.6% and the addition of new franchised restaurants.

International Lead Markets segment

The revenues from the International Lead Markets segment increased 1.6% in 2017 to ~$7.3 billion compared to ~$7.2 billion in 2016. This revenue growth was driven by a positive SSSG of 5.3% and the net addition of 214 franchised restaurants. However, some of the revenue growth was offset by a decline in the unit count of company-owned restaurants by 144.

High-Growth Markets segment

The High-Growth Markets segment posted revenues of ~$5.5 billion in 2017, which represents a fall of 10.2% from ~$6.2 billion in 2016. The company operated 1,763 fewer company-owned restaurants by the end of 2017, which led to a fall in the segment’s revenues. However, some of the declines were offset by a positive SSSG of 5.3% and the net addition of franchised restaurants by 2,095 units.

Foundational Markets segment

The revenues from the Foundational Markets segment fell 35.0% in 2017 to ~$1.9 billion compared to ~$3.0 billion in 2016. By the end of 2017, the company operated 407 fewer company-owned restaurants compared to the unit count at the end of 2016, which led to a fall in the segment’s revenues.

However, some of the declines were offset by a positive SSSG of 9.0% and an increase in the unit count of franchised restaurants by 466 units.