Should You Invest in Electronic Arts?

Along with its move toward the digital space, console upgrades are the reason Electronic Arts stock returned 66% to shareholders in 2013 and 105% in 2014.

April 7 2015, Updated 10:05 a.m. ET

Strong management and vision transitions company

Electronic Arts (EA) hired Andrew Wilson as CEO in 2013. As mentioned in another series on Electronic Arts, the company was hugely criticized for earning the “worst company in America” title twice. Yet, as a result of enhanced sales and marketing efforts, along with its digital distribution methods, Electronic Arts has delivered decent earnings and good cash flows in the last two years. Its performance has led to a sharp appreciation in its stock, which has benefited EA investors.

Before joining EA, Andrew Wilson was associated with Starbucks (SBUX), a company known for its loyal customer base. According to research firm Brand Keys, Starbucks owes its loyal customer base to both its retail brewed and packaged coffee.

To invest in Electronic Arts, consider the Sector SPDR Trust SBI Interest (XLK). Electronic Arts makes up about 0.47% of this ETF.

Console upgrades and transition toward digital space improves financial performance

As noted earlier in this series, console upgrades have been positive for the video gaming industry. Along with its transition toward the digital space, console upgrades are the reason Electronic Arts stock returned 66% to shareholders in 2013 and 105% in 2014. For context, the S&P 500 Index gained 12% in 2014.

According to the company, the “ongoing digital transformation,” game offerings, and increased focus on managing costs has allowed it to post a better performance.

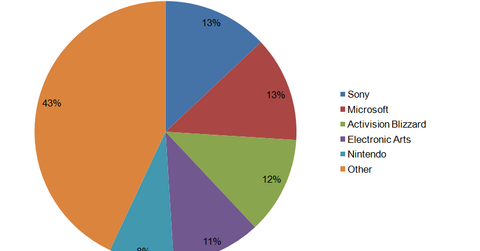

EA’s competitors in the video gaming space—Activision Blizzard (ATVI) and Take-Two Interactive Software (TTWO)—also reported triple-digit growth in 2014.

Expectations

In 4Q15, EA expects revenues and EPS (earnings per share) to be approximately $830 million and 22 cents per share, respectively. In fiscal 2015, revenues are expected to range between $4.18 billion and $4.25 billion, and EPS is expected to come in at $2.05 to $2.35.