Why Domino’s Pizza Has So Much Debt

Domino’s debt is high because it was the product of a leveraged buyout. The latest recapitalization happened in 2012, leaving it with $1.57 billion in debt.

April 9 2015, Updated 12:05 p.m. ET

High leverage

Domino’s Pizza (DPZ) has high leverage compared to many of its competitors. Its net debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio is 3.91x compared to an industry average of 1.6x based on 12 restaurants. Papa John’s (PZZA) has a net debt-to-EBITDA ratio of 1.33x, and Pizza Hut’s parent, Yum! Brands (YUM), has a leverage ratio of 1.20x.

With 97% of restaurants franchised, and fewer prospects to open company-owned stores, you may ask why Domino’s has so much debt?

Recapitalization

To answer this question, we have to go back to the year 1998 when an investment funds group associated with Bain Capital LLC completed a recapitalization deal to acquire what is now Domino’s from then-owner Thomas Monaghan and family. The company went public with an IPO (initial public offering) in 2004 under the name Domino’s Pizza, carrying the ticker symbol DPZ.

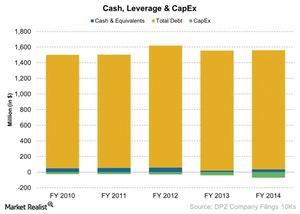

The company debt came due in 2007, but it underwent another recapitalization transaction with the issuance of $1.7 billion in debt. The latest recapitalization transaction happened in 2012, leaving the company with $1.57 billion in debt. This debt obligation is coming due in 2019, when the company may go for yet another round of recapitalization.

Leveraged buyout

So, Domino’s debt is high because it was the product of a leveraged buyout. Burger King (QSR), which recently completed the acquisition of Tim Horton’s, also has a high debt-to-EBITDA ratio of 3.83. Some restaurant chains, such as Chipotle Mexican Grill (CMG), don’t have any debt. CMG makes up 1% of the Consumer Discretionary Select Sector SPDR Fund (XLY).

On the positive side, Domino’s does have a 28% return on assets, one of the best in the industry. This means management uses Domino’s assets more effectively than others.

Nest, we’ll look at Domino’s stock performance and give you an overview of its recent earnings.