Suppliers’ power is increasing in the automobile industry

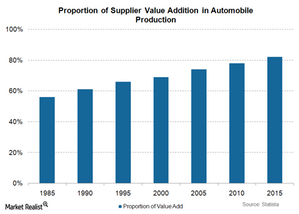

Auto suppliers’ contribution increased from 56% in 1985 to about 82% now. Automakers are becoming more like assemblers and less like manufacturers.

Nov. 19 2019, Updated 7:13 p.m. ET

Suppliers’ bargaining power

Automobile production requires thousands of parts. A large number of suppliers are needed to manufacture all of the parts that go into making a vehicle. There are many players in the auto supplier industry. Traditionally, suppliers’ bargaining power has been very low. However, the scenario changed slowly over the years.

Auto suppliers’ value addition is increasing

Auto suppliers’ contribution increased from 56% in 1985 to about 82% now. Automakers are becoming more like assemblers and less like manufacturers. Apart from the engines that still distinguish the giants from the lesser known automakers, most of the parts are now produced by suppliers. This led to the formation of “mega suppliers.” It refers to the 20 largest global automotive suppliers.

Why are automakers outsourcing more?

In the past decade, automobile manufacturers expanded significantly in the international markets in emerging countries—Latin America, China, and Asia-Pacific. In order to have a reliable supplier base, they encouraged the European and American suppliers to set up their own factories in these emerging markets.

As a result, the mega suppliers grew. The suppliers became global. Automakers concentrated on building dealer networks, marketing, and sales functions.

Working closely with manufacturers, suppliers spend a significant amount of money on research. Bosch is the biggest supplier globally. It spent 9.9% of its sales on research and development, or R&D, in 2013. In contrast, General Motors (GM) spent 3.5% of its sales on R&D.

The biggest suppliers provide similar products to different brands. The world’s third biggest auto supplier is Johnson Controls (JCI). It provides batteries and seating solutions to major brands like Ford (F), Toyota (TM), and Volkswagen. Major suppliers’ bargaining power increased as automakers became more dependent on fewer suppliers.

Investors can get exposure to auto suppliers through product specific funds. Johnson Controls represents 5.73% of the Global X Lithium ETF (LIT).

In the next part of this series, we’ll discuss global automakers’ revenue distribution.