PNC Bank loan book carries some risks

PNC Bank’s loan book is skewed toward a few types of loans: commercial and industrial loans and 1–4 Family First Liens, about 44.5% of its total loans.

Feb. 23 2015, Updated 8:05 p.m. ET

PNC Bank’s varied loan offerings

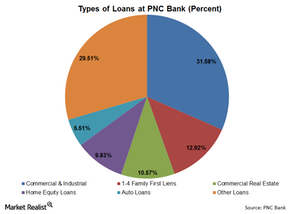

PNC Bank (PNC) offers a variety of loan products to its consumers. The five biggest loans products by the funds disbursed are:

- commercial and industrial loans

- 1–4 Family First Liens or Mortgages

- commercial real estate loans

- home equity loans

- auto loans

The bank also disburses a variety of other loans, including credit card accounts and farm and agricultural loans, as a respectable part of its loan book. Peers such as Wells Fargo (WFC), US Bank (USB), and Capital One (COF) also offer these products. All these banks are important components of the Financial Select Sector SPDR ETF (XLF).

PNC’s concentrated loan book

PNC Bank’s loan book is skewed toward a few types of loans. Commercial and industrial loans and 1–4 Family First Liens account for nearly 44.5% of PNC Bank’s total loans.

Poor growth or instances of increased delinquencies in these two types of loans would impact the bank severely. The bank would benefit from reducing this dependence in the coming years and aim for a more diversified loan book.

High-yield loans are smaller percentage of PNC’s loan book

PNC Bank does well in some types of loans in terms of yield. 1–4 Family First Mortgages account for 24.64% of total interest income, despite being only 13% of the loan book. The yield on 1–4 Family Mortgages is a healthy 4.51%. The average industry yield for 1–4 Family First Mortgages is close to 4%.

However, the yield on the largest loan segment of PNC Bank—commercial and industrial—is lower than its peers. Commercial and industrial loans yield 3.35% against an industry average yield of 3.68%. Despite being 31.58% of the total loan book, commercial and industrial loans account for only 22.60% of total interest income. Similarly, the yield on credit card accounts is also lower than the industry average.