MetLife is a key player in the US group insurance business

MetLife is the market leader in the Large market with ~30% of the market share, while its market share is slightly above 5% in the Middle market.

Feb. 27 2015, Updated 10:05 a.m. ET

Group insurance products

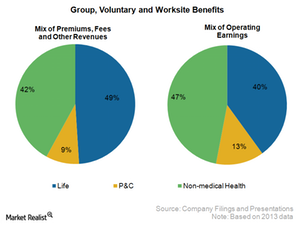

MetLife (MET) provides group insurance to corporate clients through the Group, Voluntary & Worksite Benefits (or GVWB) business segment. In this segment, key products include life, non-medical health—like dental insurance and disability insurance—and P&C insurance.

Revenue from its life insurance business contributes close to half the revenue and 40% of operating profit for the segment. Non-medical health insurance is the next key contributor to revenue and operating profit.

Market shares in various segments

The group insurance segment is further classified as large, middle, and small markets, depending on the number of persons covered under one group policy. For example, the Large market comprises group policies with 5,000 lives or more, while the Middle market provides insurance to policies covering 100–4,999 lives.

MetLife is the market leader in the Large market with ~30% of the market share, while its market share is slightly above 5% in the Middle market. The company intends to protect market share in the Large market through pricing discipline, and plans to increase its share in the middle market through improved products and distribution channels.

Property and casualty products

Property and casualty (P&C) insurance products provide close to 10% of the revenues of this segment and is a profitable business unit. In the personal lines market, in which MetLife operates, the large players include Allstate (ALL), Travelers (TRV), and AIG (AIG), as well as peers in the Financial Select Sector SPDR ETF (XLF). The company focuses on expanding this business as part of its strategy.

In the next article, we’ll look at MetLife’s other businesses with corporate customers.