How insurers manage their capital requirements

A company managing higher risk products must maintain a higher level of minimum capital compared to a company with a relatively lower level of risk.

Nov. 21 2019, Updated 2:33 p.m. ET

Risk-based capital in the US

Due to the fiduciary nature of the insurance business, insurers need to allocate a significant amount of their investment assets to liquid low-yield assets as regulatory capital. This helps them ensure timely payments for unexpected or large claims.

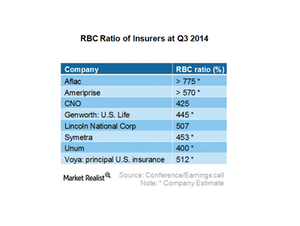

US-based insurers, several of which see allocation in the SPDR S&P Insurance ETF (KIE), must maintain risk-based capital (or RBC). RBC is the minimum amount of capital an insurer needs to hold for the amount of risk in its product portfolio. For example, a company managing higher risk products must maintain a higher level of minimum capital compared to one with a relatively lower level of risk. The RBC method specifies the minimum amount of capital to be maintained, and it is a normal practice among the prominent players to hold higher levels of capital to maintain adequate coverage.

When minimum capital isn’t maintained

When a company is unable to maintain the minimum capital requirement according to the RBC method, it must work with regulators to restore its status. In this regard, the National Association of Insurance Commissioners (or NAIC) outlines the levels of required capital and the parties involved in this process.

For example, at a level of 150–200% RBC ratio, an insurer must undertake company-level action to lift the ratio above 200%. All key insurance groups maintain an RBC ratio at a much higher level.

Global solvency regimes

At a global level, there is an effort toward convergence of solvency regimes, which are rules to develop the capital requirements of an insurer. Solvency II, the upcoming solvency regime, offers a risk-based methodology to calculate capital requirements for insurers. This regime contrasts to the volume-based methodology of Solvency I, the present system.

Plus, US insurers AIG (AIG), MetLife (MET), and Prudential Financial (PRU) were categorized as Global Systemically Important Insurers (or G-SIIs) in 2013, along with six other global peers by the Financial Stability Board. This implies increased regulations for these insurers along with stronger supervision, although the details may not be finalized until 2016.