The evolution of online advertising

Since its inception in the early 90’s, online advertising has exponentially increased in growth.

Dec. 6 2019, Updated 1:50 p.m. ET

Online advertising

Online advertising, also known as Internet advertising or online marketing, is a type of advertising that uses the Internet to deliver its marketing message to consumers. Since its inception in the early 90’s, Internet advertising has exponentially increased in growth. Online advertising includes search advertising, social media advertising, display advertising (including web banner advertising), and mobile advertising. It is used widely across all industries.

According to the Internet Advertising Revenue Report from the Interactive Advertising Bureau (or IAB), Internet advertising revenues in the US climbed to a historic high of $12.4 billion for 3Q14, representing 17% growth year-over-year. This figure reflects how brands are embracing digital as a must-have in their marketing mix. Approximately 70% of online ad revenue is concentrated in the top 10 ad networks and platforms, according to the IAB.

According to a news report from ZenithOptimedia, a division of ad firm Publicis, industry analysts expect global ad spending to grow 5.5% this year to $537 billion, while Internet ad spending will grow 14.8% and will account for nearly a quarter of total spending, at $121 billion.

Google dominates the online ad market

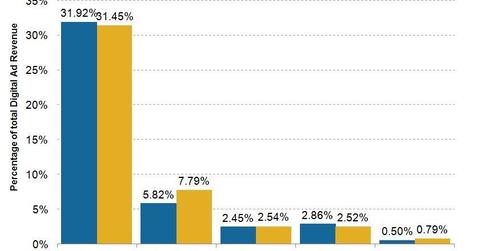

As the above graph shows, Yahoo’s (YHOO) share of digital advertising market will fall from 3.4% to 2.5% in 2014, as per eMarketer estimates. At the same time, Microsoft (MSFT) with a 2.5% share will surpass Yahoo for the first time, increasing its net worldwide ad revenues by more than 20% over 2013. Google (GOOG) will continue to dominate the global digital ad market in 2014, netting 31.5%.

Read Market Realist’s article on Google’s dominance in digital advertising market for more information. Facebook (FB) and Twitter (TWTR) are making the biggest market share moves this year. While Facebook will increase its share from 4.1% to 7.7% in 2014, Twitter will see the next largest growth in market share, reaching 0.8%, up from 0.3% in 2012.