Highlights of TPG-Axon Management’s Dropped Positions in 4Q14

In 4Q14, TPG-Axon sold its stakes in Macy’s (M), Monsanto (MON), Alibaba Group Holding (BABA), and Vantiv (VNTV).

April 15 2015, Updated 10:52 a.m. ET

TPG-Axon Management

Founded by Dinakar Singh in 2005, TPG-Axon Management is a privately owned hedge fund firm. Headquartered in New York and with offices in Hong Kong and Tokyo, TPG-Axon Management is a partnership with private equity firm Texas Pacific Group.

The fund’s US long portfolio contains 14 stocks. The fund’s portfolio declined to $1.3 billion in 4Q14 from its earlier value of $1.5 billion in 3Q14.

Top holdings

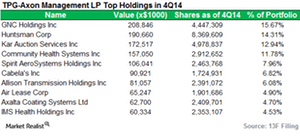

The below table shows the top stocks that TPG-Axon Management holds:

As evident from the above figure, GNC Holdings (GNC) and Huntsman (HUN) were among the top holdings of the fund in 4Q14.

Sold positions

The below table shows the positions that the fund sold in 4Q14.

In 4Q14, TPG-Axon sold its stakes in Macy’s (M), Monsanto (MON), Alibaba Group Holding (BABA), and Vantiv (VNTV).

In the next part of this series, we’ll look at TPG-Axon’s dropped position in Macy’s (M), which is part of the Consumer Discretionary Select Sector SPDR Fund (XLY).