GNC Holdings Inc

Latest GNC Holdings Inc News and Updates

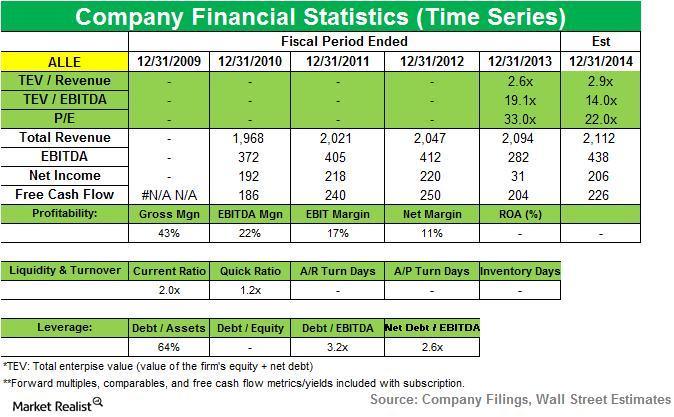

Trian Fund lowers its position in Allegion

Allegion provides security solutions for homes and businesses, employing more than 8,000 people and selling products in more than 120 countries across the world. Allegion reported third-quarter 2014 net revenues of $546.7 million, up 3.3% compared to the previous year.

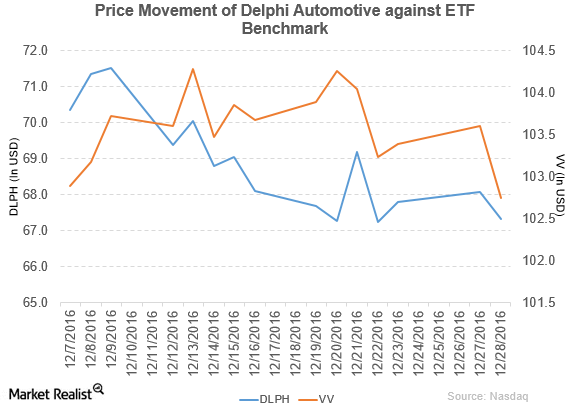

BMO Capital Rated Delphi Automotive as ‘Outperform’

Delphi Automotive (DLPH) reported net sales of $4.1 billion in 3Q16, a rise of 13.9% compared to its net sales of $3.6 billion in 3Q15.

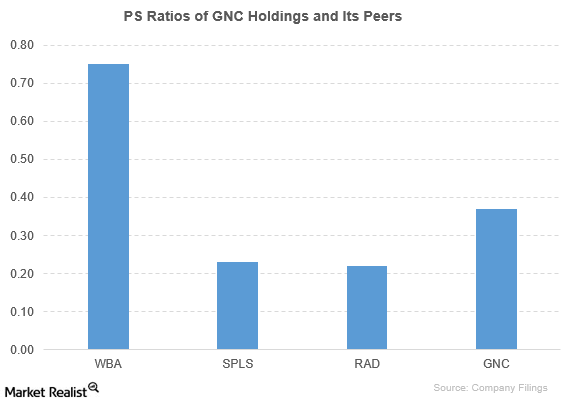

How Does GNC Holdings Compare to Its Peers?

GNC’s peers have outperformed GNC Holdings based on PE and PBV ratios. But GNC has mostly outperformed its peers based on PS ratios.