An Analysis Of Starbucks’s EBITDA

Starbucks’s EBITDA is lowest in second quarters, which shows the seasonality of the business. Adverse weather conditions can also affect EBITDA.

Jan. 27 2015, Updated 1:14 p.m. ET

A Starbucks overview

So far in this series, we’ve covered Starbucks Corporation’s (SBUX) revenues, same-store sales growth, unit growth, segment performance, and expectations in the upcoming earnings to be announced on January 22.

EBITDA analysis

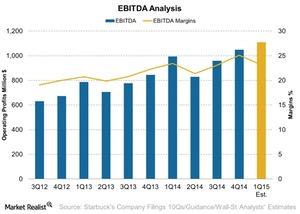

EBITDA (earnings before interest, tax, depreciation, and amortization) is the purest measure of a company’s revenue performance for any given financial period. Looking at the above chart, you can see that Starbucks’s EBITDA is the lowest in the second quarters, which demonstrates the seasonality of the business.

The first quarter shows the highest EBITDA because of the company’s higher sales due to the holiday season.

Wall Street analysts’ EBITDA estimate for the first quarter is $1.1 billion compared to $0.9 million a year ago in 1Q14. EBITDA margins are expected to stay at the same levels at 23%. Sequentially, the margins are expected to drop from 25% in the fourth quarter of 2014.

Seasonality and other factors affect restaurants

It’s not just seasonality that makes revenue volatile. We’ve seen restaurants reporting lower sales in the first half of 2014 because of adverse weather conditions in the United States. Several macroeconomic factors also affect sales for restaurants such as McDonald’s (MCD), Dunkin’ Brands (DNKN), and Yum! Brands (YUM). They also affect the Consumer Discretionary Select Sector SPDR ETF (XLY).

Let’s look next at some of the things to watch out for in Starbucks’s (SBUX) upcoming earnings release.