Who are the swing met coal producers in the global market?

In the seaborne met coal market, the swing producers are clearly the Australian producers. Australia is the second largest of the met coal producers. It’s the largest met coal exporter.

Dec. 17 2014, Updated 5:19 p.m. ET

Oligopoly

Most of the industries that are driven by natural resources are an oligopoly. An oligopoly is a market structure. A few players controlling a significant share of the industry. High entry barriers—capital requirements and mining permissions—prevent new players from entering the market. Regulators ensure that a single player doesn’t control a large portion of the critical natural resources.

As a result, commodities are an oligopoly. The market isn’t a monopoly. It doesn’t have perfect competition.

Major exporters

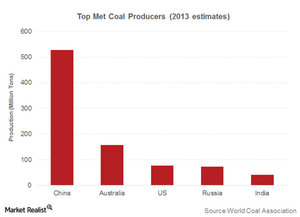

In 2013, there were 308 million tons of met coal exports. In terms of production, the top three countries accounted for over 87% of the market.

BHP Billiton (BHP), Rio Tinto (RIO), Alpha Natural Resources (ANR), and Peabody Energy (BTU) are some of the largest met coal producers and exporters (KOL) in the world. BHP, RIO, and BTU produce met coal in Australia. ANR produces met coal from its mines in the Appalachian. In 2013, China was the largest met coal producer. It produced 527 million tons of met coal. China is also the largest met coal consumer and importer.

Met coal isn’t found everywhere in the world—unlike steam coal.

Swing producers

Every oligopoly has swing producers. Swing producers are the producers that can drive the prices up or down by their actions. In the seaborne met coal market, the swing producers are clearly the Australian producers. Australia is the second largest met coal producer. It’s the largest met coal exporter. If Australian producers cut production, it could benefit the entire industry.

In the next part of this series, we’ll discuss the current situation in the global met coal industry.