A Look at Mining Stocks’ Price Movement

Mining stocks’ reaction On Tuesday, October 31, precious metal mining stocks fell, following precious metals. In this part of our series, we’ll look at the moving averages and returns of four key mining stocks: Silver Wheaton (SLW), Hecla Mining (HL), Alacer Gold (ASR), and IAMGOLD (IAG). Hecla Mining and Alacer Gold have fallen 9.9% and 10.3%, respectively, YTD […]

Nov. 1 2017, Updated 2:50 p.m. ET

Mining stocks’ reaction

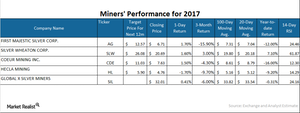

On Tuesday, October 31, precious metal mining stocks fell, following precious metals. In this part of our series, we’ll look at the moving averages and returns of four key mining stocks: Silver Wheaton (SLW), Hecla Mining (HL), Alacer Gold (ASR), and IAMGOLD (IAG).

Hecla Mining and Alacer Gold have fallen 9.9% and 10.3%, respectively, YTD (year-to-date). Silver Wheaton and IAMGOLD have risen 7.3% and 42.6%. TheGlobal X Silver Miners ETF (SIL) has fallen marginally, by 0.22%.

Long- and short-term averages

All of the miners but Silver Wheaton are trading below their 20-day and 100-day moving averages. A considerable discount to these moving averages suggests a price rebound, while a premium suggests a decline.

Relative strength index scores

SLW, HL, ASR, and IAG have relative strength index scores of 58.4, 22.2, 27.8, and 21.6, respectively.