Crude Oil Inventories and the OPEC Meeting in Focus

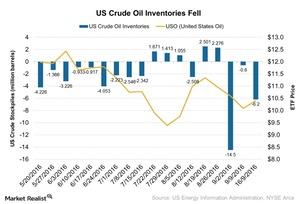

According to the EIA’s (U.S. Energy Information Administration) report on September 21, 2016, US crude oil inventories fell by 6.2 MMbbls.

Sept. 26 2016, Updated 3:04 p.m. ET

US crude oil inventories

According to the EIA’s (U.S. Energy Information Administration) report on September 21, 2016, US crude oil inventories fell by 6.2 MMbbls (million barrels) last week. Markets expected a rise of 3 MMbbls. The total compares to a drop of 0.6 MMbbls from the previous week.

The United States Oil Fund (USO) rose 3.2%, and the ProShares Ultra Bloomberg Crude Oil ETF (UCO) rose 6.7% on September 21, after the announcement of the crude oil inventories report. Crude oil prices (USO) generally react positively to inventory decreases. The rise in inventories suggests that the supply glut is increasing, adding more uncertainty to crude oil prices.

However, on Friday, September 23, crude oil prices tumbled as Saudi Arabia, the major producer of crude oil, hinted at no production output limit deal from the OPEC meeting this month. Investors are waiting for the outcome of the OPEC (Organization of the Petroleum Exporting Countries) meeting with other major oil producers about a production freeze decision in September 2016.

OPEC chief’s comments

The secretary-general of OPEC, Mohammed Barkindo, said on Saturday, September 17, that there would be no decision among members at informal talks. He said, “It is an informal meeting. It is not a decision-making meeting.”

These comments are increasing investor speculation that there might be no production freeze at the OPEC meeting. If production freeze talks fail, then we might see some downward pressure on crude oil (UWTI)(BNO)(DWTI).

In the next part of this series, we’ll analyze the performance of the US flash manufacturing PMI for September 2016.