Enterprise Products Partners acquires Oiltanking Partners

On October 1, 2014, Enterprise Products Partners (EPD) announced its acquisition of Oiltanking Partners L.P. (OILT), a midstream energy master limited partnership

Nov. 20 2020, Updated 2:45 p.m. ET

An important acquisition

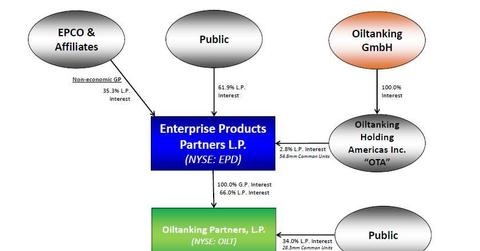

On October 1, 2014, Enterprise Products Partners (EPD) announced its acquisition of Oiltanking Partners L.P. (OILT), a midstream energy master limited partnership, or MLP. Oiltanking Holding Americas, Inc., or OTA, is the general partner of OILT. OTA is a wholly owned subsidiary of Oiltanking GmbH.

Combining OILT‘s business, EPD will add a supply-side dimension to its strong midstream operations.

Before going into the details of the acquisition transaction, let’s get a sense of the business and assets of EPD and OILT to see why these two parties came together to strike a deal.

Oiltanking Partners (OILT) is a Delaware-based master limited partnership that operates in the midstream energy sector. OILT engages in marine terminaling, storage, and transportation of crude oil, refined petroleum products, and liquefied petroleum gas, or LPG. OILT’s terminal assets are located along the U.S. Gulf Coast on the Houston Ship Channel and in Beaumont, Texas. OILT operates through two subsidiaries, Oiltanking Houston, L.P., or OTH, and Oiltanking Beaumont Partners, L.P., or OTB.

Oiltanking Partners’ assets and capacity

As of June 30, 2014, OILT had ~23.6 million barrels of total active storage capacity at its Houston and Beaumont facilities. These facilities are connected to 23 key refining, production, and storage facilities along the Gulf Coast and Cushing, Oklahoma. OILT’s storage serves both dedicated and common carrier pipelines. Plus, OILT provides deepwater access and international distribution capabilities to its customers.

A master limited partnership is a company that’s specially structured so that it doesn’t pay corporate taxes. It’s fundamentally a publicly traded limited partnership. Some of the major midstream energy MLPs include Plains All American Pipeline (PAA), Energy Transfer Partners (ETP), and Targa Resources (NGLS). Some of these MLPs are components of the Alerian MLP ETF (AMLP).

MLP management is coordinated by the general partner or GP, which often has a 2% economic stake in the enterprise. The limited partner unitholders have the other 98%. Sometimes the GP has a special right to incremental distributions, dubbed incentive distribution rights or IDRs. For more on MLP basics, click here.