Why Micron’s management is optimistic about DRAM growth

Information technology researcher Gartner expects the smartphone market to grow at an average rate of 10% in the next five years. And, the PC market will continue to decline during that period.

Sept. 1 2020, Updated 12:04 p.m. ET

Elpida acquisition and growth in mobile space benefits DRAM operations

Micron Technology Inc.’s (MU) 2013 acquisition of Elpida Memory Inc. increased the company’s DRAM revenues. It also gave Micron access to Apple Inc. (AAPL), a key customer. Plus, as discussed earlier in the series, PC and computing form a major part of the DRAM segment. Slower-than-expected growth in PC shipments has worked in favor for the company’s DRAM segment.

Information technology researcher Gartner expects the smartphone market to grow at an average rate of 10% in the next five years. And, the PC market will continue to decline during that period. Elpida makes mobile-based DRAM products, pushing Micron to benefit from the exponential growth in the mobile space.

To learn more about the Elpida acquisition, please read Market Realist’s series, Why Elpida helped Micron achieve better-than-expected earnings.

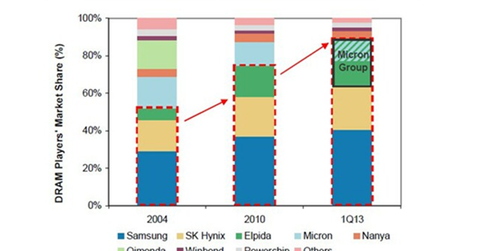

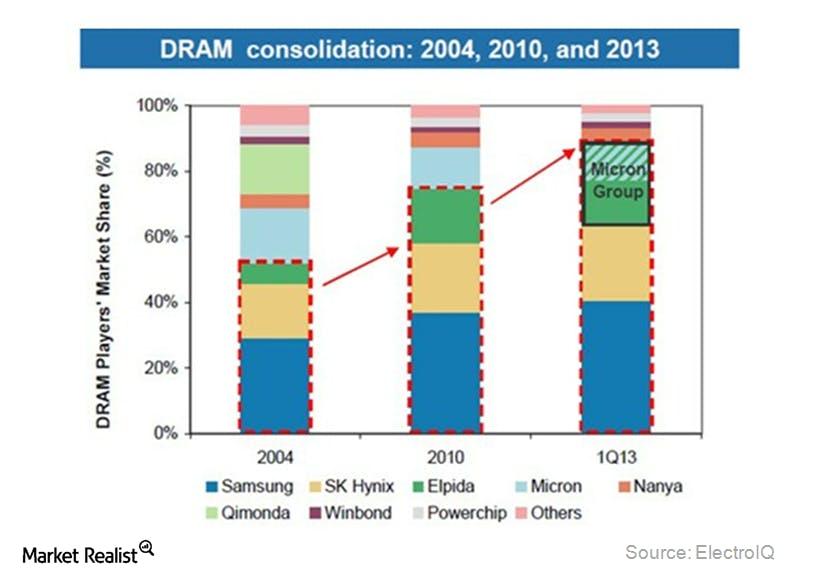

DRAM memory consolidation

As the above chart shows, there were 41 listed suppliers in 1980. According to electronics manufacturing news source Electroiq, since acquiring Elpida, Micron is among three suppliers controlling ~90% of the DRAM market. The other two companies are Samsung Electronics Ltd. (SSNLF) and SK Hynix Semiconductor (HXCSF).

Qimonda AG (QI) is also a key DRAM memory products provider.

Gartner reported that the memory market grew 23.5% in 2013, mainly because of growth in the DRAM market. The global semiconductor market grew 5% in 2013. But sudden increase in demand was not the key factor driving memory market growth. As the above chart shows, DRAM industry consolidation led to weak supply growth, which in turn increased prices and pushed up demand.

Positive long-term outlook for the memory industry

Micron’s management expects DRAM industry supply to grow ~30% in 2013. In 2015 and later, industry supply growth is expected in the mid-20% range. To learn more about supply and demand in this market, read, Why supply constraints drive growth in the memory space.

Huge growth expected in DRAM space

Gartner expects the global DRAM market to grow from $35.6 billion in 2013 to $37.9 billion in 2014. Recognizing the growth potential, Micron management plans to allocate 50% of its capital expenditure towards research and development in the DRAM space.