Must-know: Is an increase in deferred revenues cause for concern?

Salesforce.com (CRM) has a subscription business. It collects revenue for many of its offerings and applications before services. The company reports that the “deferred revenue” is rendered from its customers. In 2011, deferred revenue formed 65% of its liquid assets. It grew to 95% in 2014.

Sept. 16 2014, Updated 9:00 a.m. ET

Increase in deferred revenue necessary to fund growth

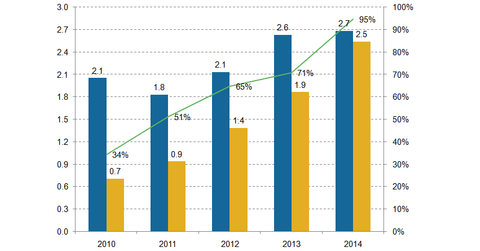

Salesforce.com (CRM) has a subscription business. It collects revenue for many of its offerings and applications before services. The company reports that the “deferred revenue” is rendered from its customers. In 2011, deferred revenue formed 65% of its liquid assets. It grew to 95% in 2014. Liquid assets include cash and equivalents, accounts receivable, and marketable securities. An increase in deferred revenues indicates growth in the business pipeline. However, it also raises the concern that customers’ prepayments, or deferred revenue, fund 95% of the company’s liquid assets.

When the company’s growth slows down or acquisitions don’t result in expected synergies, it relies on deferred revenues to fund its growth. This implies that continued increases in deferred revenues are necessary for the Salesforce.com to stay afloat.

Positive news about Salesforce.com will benefit the DJ Internet Index Fund (FDN), the First Trust ISE Cloud Computing Index ETF (SKYY), and the SPDR Morgan Stanley Technology ETF (MTK).

The previous chart shows Salesforce.com’s liquid assets and deferred revenues. It shows them as the percentage of liquid assets over the years.

Stock-based compensation and losses on a GAAP basis

Salesforce pays ~12% of its revenues in stock compensation. Amazon (AMZN) is its peer in the cloud space. AMZN has $11 billion in liquidity. It pays 1.5% in stock-based compensation. Salesforce pays 12% in stock-based compensation.

Stock-based compensation is generally used to attract and retain the workforce. Without stock-based compensation, salaries have to be elevated to make up for it. It dilutes the share count. This implies that although it’s a non-cash expense, it certainly isn’t free.

Under generally accepted accounting principles (or GAAP), stock-based compensation is considered as an expense. This explains Salesforce’s GAAP operating loss and negative net income. Stock-based compensation is added back into the non-GAAP system. Under the non-GAAP system, Salesforce appears to be profitable. It isn’t included in the calculation of operating cash flow. This doesn’t provide a realistic picture of cash flows. In 2Q15, the company lost $0.10 per share on a GAAP basis. However, it earned $0.13 per share on a non-GAAP basis.