Pianalto’s take on the Fed funds rate before the financial crisis

When consumers can borrow at lower interest rates, they can afford to buy more goods and services, and the businesses that supply those goods and services can hire more people.

Dec. 4 2020, Updated 10:53 a.m. ET

Controlling the Fed funds rate

Sandra Pianatlo went on explaining how the Fed used its conventional tool to control the Federal funds rate, while maintaining high employment level and price stability.

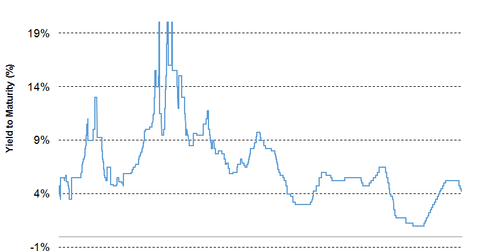

Before the crisis, the Federal Reserve’s main monetary policy tool was to target the federal funds rate. For example, during the period of 2000-2008, the unemployment rate in the U.S. was about 5.1%, whereas, the inflation was nearly at an average of 2.9%. So, to balance out the high unemployment effect, the Fed kept its interest rate nearly low, in the range of 2%-5%, with an exception for the period 2003 to mid 2004, when the Fed funds rate declined to about 1% with unemployment reaching at 6.0% levels.

Implications

Essentially, the change in the Fed funds rate influences economic activity by changing the cost of funds for both the shorter and longer terms. So, when the Federal funds rate goes down, car loans get cheaper, home mortgage rates decline, and even credit card rates may decrease. Low interest rates have a positive impact on the bonds and broader-based funds. In a declining interest rate environment, investing in bonds is recommended, due to appreciation in the bond prices. Investors can invest in ETFs such as Vanguard Total Bond Market ETF (BND) to take benefit of falling interest rates. However, when interest rates rise, bond prices fall. To negate the effect of rise in the interest rates, investor may consider floating rate bond funds such as Power Shares Exchange-Traded Fund Trust II (BKLN) and Pyxis/iBoxx Senior Loan (SNLN) with holding in H.J. Heinz Company (HNZ) and Dell International (DELL). The BKLN and SNLN fund pays floating interest rate benchmarked to LIBOR[1. “LIBOR” stands for the “London Interbank Overnight Rate,” and it’s the benchmark interest rate for many adjustable-rate mortgages, business loans, and financial instruments traded on global financial markets. Currently, the three-month LIBOR is 0.24%]+125 basis point or 150 basis point and adjusts with the change in the market interest rates.

From an economic standpoint, lower interest rate spurs the consumers’ affordability, because “when consumers can borrow at lower interest rates, they can afford to buy more goods and services, and the businesses that supply those goods and services can hire more people (to meet the incremental demand),” said Pianalto. This in turn also leads to higher spending as measured by personal consumption expenditure (or PCE), as people have more money to spend.

The reverse happens when the Fed raises the target Federal funds rate. “So that is why targeting the lower federal funds rate for many, many years was an effective way for the Federal Reserve to fulfill its objectives,” said Pianalto.

Sandra Pianalto also expressed her views on the monetary policy on the brink of 2008 depression and how the Fed’s decisions impacted the economy. These views are discussed in the next part of this series.