Comparing ETFs and closed-end MLP funds: An investor’s guide

CEFs are an alternate way to gain MLP exposure besides ETFs. Popular ETFs include Alerian MLP ETF (AMLP), Yorkville High Income MLP ETF (YMLP), and MLP ETF (MLPA).

April 8 2014, Updated 3:34 p.m. ET

Over the past few weeks, two master limited partnership closed-end funds executed initial public offerings. Closed-end funds represent another way to gain exposure to the energy master limited partnership sector, and we discuss the differences between closed-end funds and exchange traded funds in this section, as well as provide details on the closed-end funds.

Comparing ETFs and closed-end funds

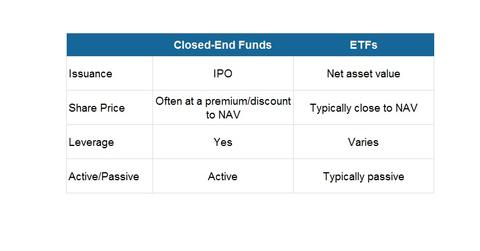

A closed-end fund (or CEF) is a collective investment scheme that has a fixed number of shares. Typically, closed-end funds are similar to mutual funds in that they are are investment companies that purchase various kinds of financial assets in order to achieve long-term growth. Closed-end fund shares are similar to ETFs in that they are listed on securities exchanges and trade intraday on the market. However, one major difference between the two are that closed-end funds are generally actively manged, while ETFs generally track a pre-determined index and are therefore passively managed.

Another major difference between the two are that the market prices of closed-end funds are often 10% to 20% higher or lower than their NAV, while the market price of an ETF is typically within 1% of its NAV. This is because shares of an ETF are usually redeemable for a basket of securities of the same type and proportion as held by the ETF, so issuance of shares of an ETF are ongoing and at net asset value. This ability to purchase and redeem ETF units minimizes the potential deviation between the market price and the net asset value of ETF shares. If the price of a share of the ETF trades significantly below its net asset value per share, the price difference can be arbitraged away by buying shares of the ETF and redeeming them for the underlying securities. The additional demand for the ETF shares pushes the market price per share back in line with the underlying net asset value. The same occurs in reverse when the price of a share of an ETF significantly exceeds its net asset value. Meanwhile, closed-end funds do not issue new shares on an ongoing basis. Closed-end funds execute an initial public offering to raise a pool of funds (similar to how single-name stocks IPO), and use this pool to purchase assets. Because it’s not easy to arbitrage away differences in the price of a share of closed-end funds and the underlying net asset value per share, CEFs can trade at a significant premium or discount to their net asset values. Another last difference is that CEFs can often use leverage as a strategy to generate excess returns (ex: borrowing money to magnify gains), whereas MLP ETFs generally do not.

In this series, we discuss Nuveen All Cap Energy MLP Opportunities Fund (JMLP) and The First Trust New Opportunities MLP & Energy Fund (FPL) which are newly issued closed-end funds (CEFs). CEFs are an alternate way to gain MLP exposure besides ETFs. Popular ETFs include Alerian MLP ETF (AMLP), Yorkville High Income MLP ETF (YMLP), and MLP ETF (MLPA).