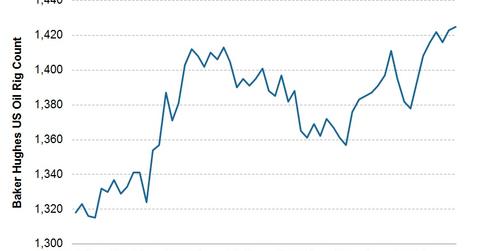

US oil rig counts continue to rally, reaching a year-to-date high

Last week, the Baker Hughes oil rig count increased from 1,423 to 1,425, reaching the highest level since 2014 began.

Dec. 4 2020, Updated 10:53 a.m. ET

Oil rig counts increased last week to 1,425, touching a year-to-date high

Last week, the Baker Hughes oil rig count increased from 1,423 to 1,425, reaching the highest level since 2014 began. Oil rig counts have risen by 47 (or 3%) since the beginning of 2014, with a large part of the increase in the Permian Basin in West Texas (+23), as well as the Niobrara or DJ in the Rockies (+6), and the Cana Woodford in Oklahoma (+9). Out of the current 1,425 oil rigs at work, the majority are either in the Permian (482), the Eagle Ford (191), the Williston (174), the Mississippian (67), or the Granite Wash (48).

Baker Hughes noted on its 4Q13 earnings call that it expects an average of 1,350 oil rigs drilling at the end of 2014 and it anticipates activity to be roughly flat compared to 2013.

Oil rig counts can indicate how producers such as ExxonMobil (XOM), Pioneer Natural Resources (PXD), Oasis Petroleum (OAS), and EOG Resources (EOG) feel about the drilling and price environment. These companies also comprise ETFs such as the Energy Select SPDR ETF (XLE).

Although oil prices have declined somewhat since reaching ~$110 per barrel in early September (using WTI crude oil prices), they’ve stayed above the $90-per-barrel level for most of 2013 and into 2014 so far, which generally supports oil drilling and, consequently, a high oil rig count. For more analysis on crude oil prices, see Must-know: Why cold weather has helped crude oil prices.

Background: U.S. rig counts increased rapidly following the recession but have since flatlined

When the worst of the recession hit, U.S. oil rig counts fell from over 400 to nearly 175. Since bottoming around mid-2009, two major trends caused oil rig counts to rebound rapidly. First, when oil prices sank to below $40 per barrel in early 2009, no one was looking to drill for oil—because it was unprofitable, and frozen capital markets made raising money to fund capex programs expensive. In 3Q09, oil prices recovered to roughly $70 per barrel. Raising money in the capital markets was starting to become easier. Second, during that period, companies were beginning to drill basins that became attractive with the help of new technology, notably shale basins. From mid-2009 to now, more and more oil rigs began working in places like the Bakken Shale in North Dakota, the Eagle Ford Shale in South Texas, and the Permian Basin in West Texas, where previous drilling activity had either stagnated or been minimal.

Oil rig counts dipped somewhat in mid-2012, a period characterized by some volatility in oil markets, with WTI crude oil prices dropping from over $100 per barrel to under $80 per barrel. Oil prices have since recovered, and so have oil rig counts. Note that oil prices remained relatively buoyant over 2013, and most analysts expect oil prices to remain economic enough to drill in the major U.S. oil shale plays (the Bakken, Eagle Ford, and Permian). As companies have begun to disclose their capital expenditure plans for 2014, it seems that oil drilling activity in the U.S. will remain very active. If oil prices remain relatively high and stable, oil rig counts are likely to remain near current levels or continue to increase.