Chilton Investment Company sells its shares in CarMax in 4Q13

Chilton liquidated its position in CarMax Inc. (KMX) in the fourth quarter that had accounted for 0.71% of the fund’s third quarter portfolio.

March 24 2014, Published 5:00 p.m. ET

Chilton Investment Company and CarMax

Chilton initiated positions in Abbott Laboratories (ABT), U.S. Bancorp (USB), Macy’s Inc. (M), and TransDigm Group Inc. (TDG). The fund sold its stakes in Genesco Inc. (GCO), Bally Technologies Inc. (BYI), and CarMax Inc. (KMX).

Chilton liquidated its position in CarMax Inc. (KMX) in the fourth quarter that had accounted for 0.71% of the fund’s third quarter portfolio. The fund had initiated the position in the third quarter.

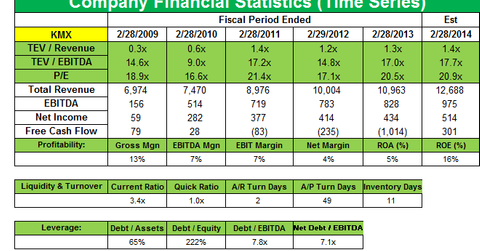

CarMax is the largest retailer of used vehicles in the United States. It operates via two segments. The CarMax Sales Operations segment consists of all aspects of its auto merchandising and service operations, excluding financing provided by the other segment. The CarMax Auto Finance or CAF segment consists solely of CarMax’s own finance operation that provides vehicle financing through CarMax superstores. As of November 30, 2013, CarMax operated 126 used car superstores in 63 markets, comprising 47 mid-sized markets, 13 large markets, and three small markets. During fiscal 2013, CarMax sold 447,728 used cars, representing 98% of the total 455,583 vehicles it sold at retail.

CarMax shares plunged after it reported its 3Q 2013 results in December of last year. The company missed Street estimates for earnings by a penny per share although its third-quarter profit was up to $106.5 million, or $0.47 a share, from $94.7 million, or $0.41 a share, a year earlier. Revenue rose to $2.9 billion, from $2.6 billion a year earlier.

Total used vehicle unit sales grew 15%, and comparable store used units grew 10% versus the prior year’s third quarter. Comparable store used unit sales benefited from improved execution in stores and an attractive consumer credit environment, as well as a modest increase in store traffic. Wholesale vehicle unit sales grew 4% compared with last year’s fourth quarter, reflecting growth in CarMax’s store base. CAF income increased 16%, to $83.9 million, as a result of the 24% increase in average managed receivables. Average managed receivables grew to $6.81 billion, reflecting the rise in CAF loan originations in recent years.

CarMax’s net third-party finance fees declined by $4.6 million as the third-party subprime providers (those who purchase financing at a discount) originated 18% of used vehicle unit sales in the current quarter versus 15% in the prior year’s third quarter. CarMax said that over the last two years, the volume of financing by third-party subprime providers has increased. But late in the quarter, CarMax began to see tightening of the credit terms offered by its subprime providers. Carmax expects to end its dependence on third-party subprime car loan providers, and via its finance unit, CAF plans to start originating loans for customers with poor credit history.

Management said on the company’s earnings call, “Customers with challenged credit have become a meaningful part of our overall business, and they’re a meaningful part of the used car market, so we feel like we owe it to ourselves to get smarter about this space.”

Analysts believe investors were concerned about this move, leading to a fall in Carmax shares after earnings. According to “US Subprime Auto Loan Credit Deterioration Moderated in Q3, Will Continue Gradually,” a January report from Moody’s Investors Service, “The deterioration in US subprime auto lending credit metrics slowed somewhat during the third quarter of 2013, but subprime credit will continue to weaken gradually as lenders boost their volumes by moving further down the credit spectrum.”

The report also said that low interest rates, relatively low losses to date, and a slowdown in auto sales growth will drive lenders to continue to offer credit to weaker borrowers. Senior director for Moody’s analytics Cristian deRitis said during a recent webinar, Automotive Credit and Lending Outlook, that although subprime penetration is slowly increasing, it was still below the levels we saw before the recession. He added that customers with credit scores of 620 or lower who are considered to be subprime accounted for approximately 20% of loan originations in 4Q, compared to around 30% pre-recession.

To learn more about the latest 13Fs for hedge fund ownership, see the Market Realist series Assessing Eminence Capital’s 4Q13 positions in Humana and more.