Must-know: Important costs involved in owning an ETF

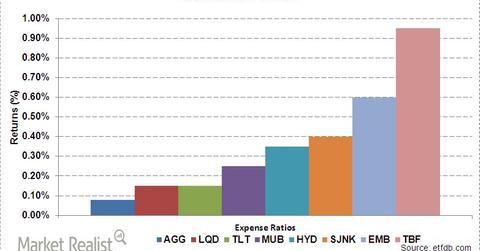

Owning an ETF comes with some fees. These fees are called “expense ratios” because they’re expressed as a percentage of a fund’s assets.

Nov. 22 2019, Updated 6:15 a.m. ET

ETF ownsership

Owning an ETF comes with some fees. These fees are called “expense ratios” because they’re expressed as a percentage of a fund’s assets. The expense ratio covers the investment advisory fee, administrative costs, and other operating expenses. On top of that, there are costs of buying a fund, which involves brokerage commissions. The investment advisory fee or management fee is the amount to pay the manager of the fund. In the case of broad index–tracking ETFs or passive ETFs, fees are low.

Administrative costs include the costs of record keeping, prospectus mailings, maintaining a customer service line and website, and other back-office costs. The expenses are expressed either as gross or net. Gross expenses of an ETF represent the ratio of the cost of running the ETF to the profit earned by the sponsor, while the net expense ratio represents the gross expense ratio minus any acquired fees and waivers or reimbursements. So, gross expense ratios affect only the fund itself, while net expense ratios reflect the amount of money paid by each investor for the fund’s operating costs.

The expense waiver is the percentage of costs a fund sponsor is willing to eat in order to keep the fund’s net expenses low. Net expense ratios indicate how much of the operating costs fund managers are willing to absorb and how much of those costs they charge to investors.

The other fee that an ETF investor should be aware of is the commission fee. Most brokerage firms charge fees when an investor buys or sells ETFs. For a long-term investor holding an ETF, this cost is minimal. In order to keep the commission of purchase low, an ETF buyer may resort to a technique called “dollar-cost averaging.” Dollar-cost averaging is an investment strategy for reducing the impact of volatility on large purchases of financial assets. By dividing the total sum to be invested in the market into equal amounts at regular intervals, dollar-cost averaging reduces the risk of incurring a substantial loss resulting from investing the entire investment just before a sudden drop in the market. However, the flip side of the strategy is the frequent trading, which might set the total commission costs soaring. To give an example, if each trade (either buying or selling) costs $10 in brokerage fees on average, for an SIP investor (Systematic Investment Plan—investing through small and periodic or monthly instalments), costs could run up to $120 per annum.

There are other costs involved in ETF trading that are based on how liquid or illiquid a fund is. We’ll discuss them in Part 2 of this series.